About Stock TradingLearn More

Dive into the world of investing with a stock trading course from Udemy. Real-world experts will help you understand the basics of buying and selling, along with the different types of modern trading including day trading, swing trading, and position trading. Decode Wall Street and make extra income — or invest in yourself and make a career change.

Sort by:

Sorting

The newest

Most visited

Course time

Subtitle

Filtering

Courses

Udemy

Hudson and Thames Quantitative Research

Advances in Momentum Trading Strategies 5:33:07

03/12/2024

Subtitle

Udemy

Md Sydur Rahman

Candlestick Wicks Reading With Volume CWRV (part 1) 8:32:05

English subtitles

08/06/2023

Subtitle

Udemy

Stephen Burnich

How To Maximize Your Profits Trading Options 2:56:10

English subtitles

07/23/2023

Frequently asked questions about Stock Trading

The stock market refers to public markets that exist for issuing, buying, and selling stocks that trade on stock exchanges. Stocks represent fractional ownership in a company. The stock market is where traders buy and sell stocks. The stock market serves two important purposes. For companies, it provides a means to acquire capital as a way to fund and expand their business. For stock traders, it provides an opportunity to share in the profits of publicly traded companies. In the U.S., there are multiple regional stock exchanges, while most other countries maintain a single stock exchange. Stock trading is the activity of buying and selling shares of publicly traded companies with the goal of securing a profit or loss.

A stock trader can work individually as an analyst or advisor or as an employee for a large corporation. An Investment Banker works with companies to find investors using their extensive knowledge of the stock market and accurately valuing the business before it becomes a publicly traded company. A Financial Manager oversees the general finances of a company, including advising on the value of any shares the company has in the stock market. A Personal Financial Advisor focuses on an individual’s finances and typically makes investments on behalf of their client. A Market Data Compliance Analyst constantly checks the market data, ensuring the share and stakeholders are aware of any changes or updates. An Accountant or Auditor is an all-around financial expert, including being up to date with all stock market trends. They prepare financial documents and provide current stock market information to their clients.

Stock traders generally have a strong finance or accounting background and often have extra training in one of those fields. Stock traders are typically detail-oriented individuals that thrive from persuading and influencing others. Someone that is a natural leader and enjoys working in a structured environment could excel as a stock trader. They may work as an employee of a large corporation, independently, or on the main floor of a trading exchange. They must make decisions quickly based on their understanding of the market and take risks to make the most money possible. The stock market runs at all hours. Depending on what time zone they live in, a workday could start early or go late into the night. A stock trader should get suited to working in a pressure-filled and fast-paced environment that requires attention to detail and commitment to the job at hand.

There are five different types of orders. The market order is a trade executed immediately at the current market price. A limit order is an order to buy or sell a number where the limit price identifies the maximum (buy) or minimum (sell) execution price. A stop order is an order to buy or sell shares when the market price reaches a stop price set by the trader. Unlike the limit order, there is no protection – in a fast market the execution price can exceed the stop price. A trailing stop order is similar to a stop order, except the stop price is determined by a percentage. The percentage is used to calculate the stop price based on the market price at the time of submission. And finally, the stop limit order allows the trader to put both a stop price and a limit price on the order. The trade will only execute within the boundaries set by the stop price and the limit price.

There are several different stock trading strategies. Day trading refers to buying and selling stocks in one day. Traders sell stocks the same day, so they never hold a position overnight. Position trading involves buying and holding stock based on anticipated trends. The goal is to identify the market direction based on prediction charts and monitor the trend to capture the apex gain/loss. At the end of a trend, the stock price fluctuates while it establishes a new price. Swing Trading takes advantage of this price volatility period and uses fundamental analysis to determine when to buy and sell. Scalping is one of the quickest trading strategies for spread advantage. The trader buys at the bid price and sells at the asking price to profit off the differential. Fading is short selling a stock when the trader believes it has been overbought. A sell trade is executed when the price passes the target trend apex. When the trend reverses and there is a price correction, the trader purchases the lower-priced stock

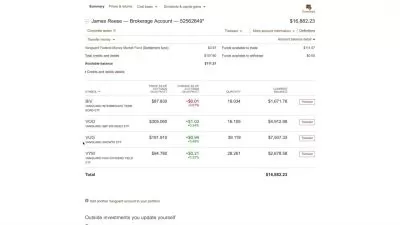

Anyone looking for a way to make extra income can learn to trade stocks. Becoming a successful trader doesn’t require an MBA or many years on the floor of a stock exchange. Some traders are self-taught and read books, articles, and websites; others take a few courses to get a good handle on how to become a successful trader. Before making your first trade, it’s important to understand how the markets work, the different types of securities you can trade, the purpose of a broker, and how to read market data. For those without prior experience, learning how to analyze the markets is also very important. You will also need to take some time to practice and observe how to execute a trade successfully. Udemy courses can teach you the basics, from opening a brokerage account and buying and selling stocks on different exchanges to more advanced, specific skills like candlestick trading and portfolio optimization.

All traders need to develop a strong understanding of how to interpret stock trends and measure the health of a business. Fundamental analysis helps traders capture the “big picture” of a particular company’s potential for profit and future growth; this type of stock analysis focuses on the long-term success of a company rather than making quick decisions based on short-term data. It requires traders to look at qualitative data and get a good understanding of a company’s health beyond its basic financial numbers. Fundamental analysis helps traders see the overall state of the economy and focus on factors like interest rates, employment rate, GDP, international trade, and manufacturing. As you develop your knowledge of the stock markets and what it takes to execute a successful trade, you’ll find that fundamental analysis skills will provide you with the essential knowledge to confidently make a successful trade.

A simple definition is that a bull market is when prices are on the rise, and a bear market is when market prices are declining. It is believed the terms originated based on how these animals attack their opponents; the bull thrusts its horns up in the air and the bear swipes its paw downwards. For example, if the market rises 20%, this is considered a bull market. If the market declines 20%, this is considered a bear market. A bull market is usually accompanied by a rise in GDP, consumer confidence, and low employment rates. There can be many reasons for a decline in the GDP, but it generally leads to lower consumer confidence and decreased spending. This will affect company performance and stock price. When companies are forced to layoff employees due to a struggling economy, it can make recovery out of the bear market difficult.