Python for Corporate Finance and Investment Analysis

John Cousins

6:36:32

Description

Introduction to Financial Automation: Empowering Financial Decision-Making Through Python Programming

What You'll Learn?

- Learn to manipulate and analyze financial data using Python

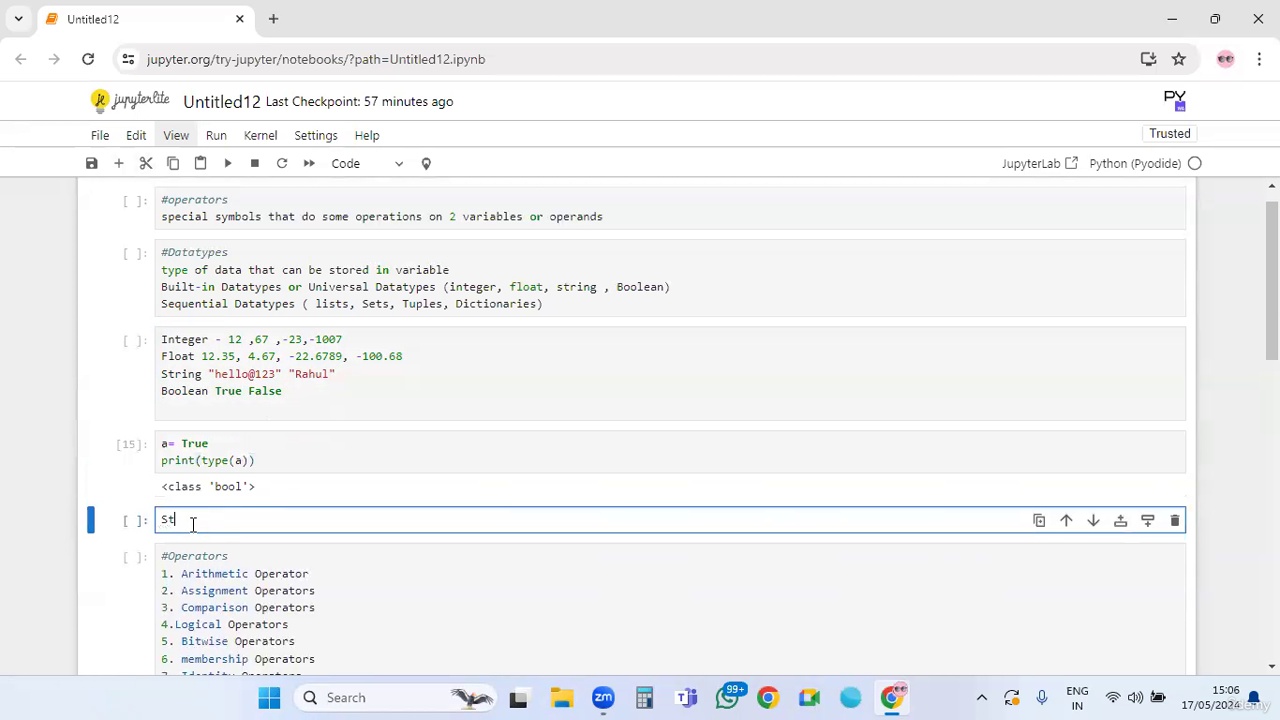

- Understand the Basics of Python Programming

- Gain a foundational understanding of Python programming, including data types, control structures, functions, and libraries essential for financial analysis.

- Acquire the ability to construct financial models and forecasts using Python, including cash flow analysis, budgeting, and financial statement analysis.

- Acquire the ability to construct financial models and forecasts using Python, including cash flow analysis, budgeting, and financial statement analysis.

- Applying the Black-Scholes model, bond yield calculation for options pricing.

- Programming with Python Write effective Python code for solving complex business problems.

Who is this for?

What You Need to Know?

More details

DescriptionFrom Data to Decisions: Python in Corporate Finance

Real-World Python Applications in Corporate Finance

Programming with Python

Write effective Python code for solving complex business problems

When it comes to programming languages, Python shines brightest when dealing with tasks related to data processing, machine learning, and web development. Python has all the necessary tools to help you succeed.

With a foundation in finance laid down, you will acquire the skills needed to develop various financial applications using Python.

Here are some of the topics we will cover in this course:

Basic Understanding of Finance and Accounting Principles:

Familiarity with fundamental concepts of corporate finance, such as cash flows, financial statements (income statement, balance sheet, cash flow statement), and basic financial metrics (ROI, ROE, etc.).

Basic knowledge of investment principles, including stocks, bonds, and other financial instruments.

Foundational Mathematical Skills:

Gain comfort with basic mathematics, including algebra and elementary statistics. Understanding of financial mathematics concepts like compounding, discounting, and basic statistical measures (mean, median, standard deviation)

Introductory-Level Knowledge of Economics:

Basic understanding of macroeconomic and microeconomic principles, as they underpin many financial theories and models.

Basic Computer Literacy:

Proficiency in using computers, especially for tasks like installing software, managing files, and navigating the internet.

No Prior Programming Experience Required:

While prior experience with programming can be beneficial, it is not a prerequisite. The course is designed to start with the basics of Python programming.

This course builds a solid foundation upon which to build your understanding of using Python in corporate finance and investment analysis. The course focuses on bridging the gap between finance and Python programming.

Harnessing Python for Effective Investment Strategies

Leveraging Python for Strategic Investment Insights

Navigating Financial Markets with Python Skills

Transformative Skills for the Modern Financial Professional

Python for the Future of Finance: Analytics and Beyond

This course includes many coding exercises in Python. These exercises will help turbo charge your career.

Integrating Python coding exercises into finance education offers several significant benefits for students. These benefits stem from the increasing role of technology and data analysis in the finance sector. Here are some key reasons why Python coding exercises are beneficial for finance students:

1. Enhanced Data Analysis Skills:

o Python is widely used for data analysis and data science. Finance students can leverage Python to analyze complex financial datasets, perform statistical analysis, and visualize data, skills that are highly valuable in today's data-driven finance industry.

2. Automation of Financial Tasks:

o Python can automate many routine tasks in finance, such as calculating financial ratios, risk assessments, and portfolio management. By learning Python, students can understand how to streamline these processes, improving efficiency and accuracy.

3. Integration with Advanced Financial Models:

o Python is versatile and can be used to develop sophisticated financial models for risk management, pricing derivatives, asset management, and more. Understanding these models is crucial for modern finance professionals.

4. Machine Learning and Predictive Analytics:

o Python is a leading language in machine learning and AI. Finance students can learn to apply machine learning techniques for predictive analytics in stock market trends, credit scoring, fraud detection, and customer behavior analysis.

5. Access to a Wide Range of Libraries:

o Python offers a vast array of libraries and tools specifically designed for finance and economics, such as NumPy, pandas, matplotlib, scikit-learn, and QuantLib. Familiarity with these libraries expands a student’s toolkit for financial analysis.

6. Preparation for Industry Demands:

o The finance industry increasingly values tech-savvy professionals. Familiarity with Python and coding in general prepares students for the current demands of the finance sector and enhances their employability.

7. Understanding of Algorithmic Trading:

o Python is extensively used in algorithmic trading. Finance students can learn to code trading algorithms, understand backtesting, and gain insights into the technological aspects of trading strategies.

8. Improved Problem-Solving Skills:

o Coding in Python fosters logical thinking and problem-solving skills. These skills are transferable and beneficial in various areas of finance, from analyzing financial markets to strategic planning.

9. Broad Applicability:

o Python is not just limited to one area of finance but is applicable across various domains, including investment banking, corporate finance, risk management, and personal finance.

10. Collaboration and Innovation:

o By learning Python, finance students can more effectively collaborate with IT departments and data scientists, bridging the gap between financial theory and applied technology, leading to innovative solutions in finance.

Incorporating Python into finance education equips students with a practical skill set that complements their theoretical knowledge, making them well-rounded professionals ready to tackle modern financial challenges.

Python: Your Gateway to Advanced Finance Analytics

This course, "Python for Corporate Finance and Investment Analysis," is tailored for a diverse range of participants who share an interest in integrating Python programming skills with financial analysis and investment strategies. The target audience includes:

Finance Professionals:

Individuals working in corporate finance, investment banking, portfolio management, risk management, and financial planning who want to enhance their analytical skills and embrace automation and data-driven decision-making in their workflows.

Business Analysts and Consultants:

Professionals in business analysis and consulting roles who seek to deepen their analytical capabilities and provide more sophisticated insights into financial performance, market trends, and investment opportunities.

Students and Academics in Finance and Economics:

University students and academic researchers in finance, economics, business administration, and related fields who aim to supplement their theoretical knowledge with practical, hands-on experience in Python for data analysis and financial modeling.

Investment Enthusiasts and Individual Traders:

Individuals managing their investments or interested in stock market trading, who want to learn how to use Python for investment analysis, portfolio optimization, and developing algorithmic trading strategies.

Career Changers and Lifelong Learners:

Professionals from non-finance backgrounds aspiring to transition into finance or investment roles, or those who are interested in personal development and acquiring new, marketable skills at the intersection of finance and technology.

Technology Professionals Seeking Finance Domain Knowledge:

IT and tech professionals, including software developers, who are looking to diversify their skillset by gaining knowledge in financial analysis and investment strategies.

This course is designed to be accessible to those new to programming while still being challenging enough for those with some experience in Python. It offers a unique blend of financial theory and practical application, making it suitable for anyone looking to enhance their skill set at the nexus of finance and technology.

Why Python?

Python is a good starting point for first-time coders. It uses simple, natural language syntax, almost like spoken English. It is powerful and it is versatile, favored by such diverse industry giants as Netflix, PayPal, NASA, Disney, and Dropbox. Python is used by 87% of data scientists.

User-Friendly Syntax: As an interpreted language, Python has simpler, more concise syntax than Java. Python's simple, concise syntax makes it easy to write algorithms with just a few lines of code

Open-Source Libraries: Pre-written code is readily available, with algorithms at your disposal, so you do not have to start every project from scratch. You can benefit from highly specific libraries – physics, web development, gaming, machine learning – by simply importing algorithms and applying them to your own data. It is plug and play at its best, with new functionalities being added all the time

Community Exchanges: Python’s popularity means it has great community support, with almost 8 million Python developers across the world to help you debug or resolve a programming challenge

Compatibility: Python is a cross-platform language and can be integrated easily with Windows and other platforms

Adaptability: Almost every field is adopting Python and needs both generalists and specialists who know how to use it. Fields as varied as gaming, web development, healthcare, and fintech prefer Python over other programming languages, making it the must-learn language for STEM professionals and data scientists

Who this course is for:

- This course, "Python for Corporate Finance and Investment Analysis," is tailored for a diverse range of participants who share an interest in integrating Python programming skills with financial analysis and investment strategies. The target audience includes:

- Finance Professionals: Individuals working in corporate finance, investment banking, portfolio management, risk management, and financial planning who want to enhance their analytical skills and embrace automation and data-driven decision-making in their workflows.

- Business Analysts and Consultants: Professionals in business analysis and consulting roles who seek to deepen their analytical capabilities and provide more sophisticated insights into financial performance, market trends, and investment opportunities.

- Students and Academics in Finance and Economics: University students and academic researchers in finance, economics, business administration, and related fields who aim to supplement their theoretical knowledge with practical, hands-on experience in Python for data analysis and financial modeling.

- Investment Enthusiasts and Individual Traders: Individuals managing their investments or interested in stock market trading, who want to learn how to use Python for investment analysis, portfolio optimization, and developing algorithmic trading strategies.

- Career Changers and Lifelong Learners: Professionals from non-finance backgrounds aspiring to transition into finance or investment roles, or those who are interested in personal development and acquiring new, marketable skills at the intersection of finance and technology.

- Technology Professionals Seeking Finance Domain Knowledge: IT and tech professionals, including software developers, who are looking to diversify their skillset by gaining knowledge in financial analysis and investment strategies.

- This course is designed to be accessible to those new to programming while still being challenging enough for those with some experience in Python. It offers a unique blend of financial theory and practical application, making it suitable for anyone looking to enhance their skill set at the nexus of finance and technology.

From Data to Decisions: Python in Corporate Finance

Real-World Python Applications in Corporate Finance

Programming with Python

Write effective Python code for solving complex business problems

When it comes to programming languages, Python shines brightest when dealing with tasks related to data processing, machine learning, and web development. Python has all the necessary tools to help you succeed.

With a foundation in finance laid down, you will acquire the skills needed to develop various financial applications using Python.

Here are some of the topics we will cover in this course:

Basic Understanding of Finance and Accounting Principles:

Familiarity with fundamental concepts of corporate finance, such as cash flows, financial statements (income statement, balance sheet, cash flow statement), and basic financial metrics (ROI, ROE, etc.).

Basic knowledge of investment principles, including stocks, bonds, and other financial instruments.

Foundational Mathematical Skills:

Gain comfort with basic mathematics, including algebra and elementary statistics. Understanding of financial mathematics concepts like compounding, discounting, and basic statistical measures (mean, median, standard deviation)

Introductory-Level Knowledge of Economics:

Basic understanding of macroeconomic and microeconomic principles, as they underpin many financial theories and models.

Basic Computer Literacy:

Proficiency in using computers, especially for tasks like installing software, managing files, and navigating the internet.

No Prior Programming Experience Required:

While prior experience with programming can be beneficial, it is not a prerequisite. The course is designed to start with the basics of Python programming.

This course builds a solid foundation upon which to build your understanding of using Python in corporate finance and investment analysis. The course focuses on bridging the gap between finance and Python programming.

Harnessing Python for Effective Investment Strategies

Leveraging Python for Strategic Investment Insights

Navigating Financial Markets with Python Skills

Transformative Skills for the Modern Financial Professional

Python for the Future of Finance: Analytics and Beyond

This course includes many coding exercises in Python. These exercises will help turbo charge your career.

Integrating Python coding exercises into finance education offers several significant benefits for students. These benefits stem from the increasing role of technology and data analysis in the finance sector. Here are some key reasons why Python coding exercises are beneficial for finance students:

1. Enhanced Data Analysis Skills:

o Python is widely used for data analysis and data science. Finance students can leverage Python to analyze complex financial datasets, perform statistical analysis, and visualize data, skills that are highly valuable in today's data-driven finance industry.

2. Automation of Financial Tasks:

o Python can automate many routine tasks in finance, such as calculating financial ratios, risk assessments, and portfolio management. By learning Python, students can understand how to streamline these processes, improving efficiency and accuracy.

3. Integration with Advanced Financial Models:

o Python is versatile and can be used to develop sophisticated financial models for risk management, pricing derivatives, asset management, and more. Understanding these models is crucial for modern finance professionals.

4. Machine Learning and Predictive Analytics:

o Python is a leading language in machine learning and AI. Finance students can learn to apply machine learning techniques for predictive analytics in stock market trends, credit scoring, fraud detection, and customer behavior analysis.

5. Access to a Wide Range of Libraries:

o Python offers a vast array of libraries and tools specifically designed for finance and economics, such as NumPy, pandas, matplotlib, scikit-learn, and QuantLib. Familiarity with these libraries expands a student’s toolkit for financial analysis.

6. Preparation for Industry Demands:

o The finance industry increasingly values tech-savvy professionals. Familiarity with Python and coding in general prepares students for the current demands of the finance sector and enhances their employability.

7. Understanding of Algorithmic Trading:

o Python is extensively used in algorithmic trading. Finance students can learn to code trading algorithms, understand backtesting, and gain insights into the technological aspects of trading strategies.

8. Improved Problem-Solving Skills:

o Coding in Python fosters logical thinking and problem-solving skills. These skills are transferable and beneficial in various areas of finance, from analyzing financial markets to strategic planning.

9. Broad Applicability:

o Python is not just limited to one area of finance but is applicable across various domains, including investment banking, corporate finance, risk management, and personal finance.

10. Collaboration and Innovation:

o By learning Python, finance students can more effectively collaborate with IT departments and data scientists, bridging the gap between financial theory and applied technology, leading to innovative solutions in finance.

Incorporating Python into finance education equips students with a practical skill set that complements their theoretical knowledge, making them well-rounded professionals ready to tackle modern financial challenges.

Python: Your Gateway to Advanced Finance Analytics

This course, "Python for Corporate Finance and Investment Analysis," is tailored for a diverse range of participants who share an interest in integrating Python programming skills with financial analysis and investment strategies. The target audience includes:

Finance Professionals:

Individuals working in corporate finance, investment banking, portfolio management, risk management, and financial planning who want to enhance their analytical skills and embrace automation and data-driven decision-making in their workflows.

Business Analysts and Consultants:

Professionals in business analysis and consulting roles who seek to deepen their analytical capabilities and provide more sophisticated insights into financial performance, market trends, and investment opportunities.

Students and Academics in Finance and Economics:

University students and academic researchers in finance, economics, business administration, and related fields who aim to supplement their theoretical knowledge with practical, hands-on experience in Python for data analysis and financial modeling.

Investment Enthusiasts and Individual Traders:

Individuals managing their investments or interested in stock market trading, who want to learn how to use Python for investment analysis, portfolio optimization, and developing algorithmic trading strategies.

Career Changers and Lifelong Learners:

Professionals from non-finance backgrounds aspiring to transition into finance or investment roles, or those who are interested in personal development and acquiring new, marketable skills at the intersection of finance and technology.

Technology Professionals Seeking Finance Domain Knowledge:

IT and tech professionals, including software developers, who are looking to diversify their skillset by gaining knowledge in financial analysis and investment strategies.

This course is designed to be accessible to those new to programming while still being challenging enough for those with some experience in Python. It offers a unique blend of financial theory and practical application, making it suitable for anyone looking to enhance their skill set at the nexus of finance and technology.

Why Python?

Python is a good starting point for first-time coders. It uses simple, natural language syntax, almost like spoken English. It is powerful and it is versatile, favored by such diverse industry giants as Netflix, PayPal, NASA, Disney, and Dropbox. Python is used by 87% of data scientists.

User-Friendly Syntax: As an interpreted language, Python has simpler, more concise syntax than Java. Python's simple, concise syntax makes it easy to write algorithms with just a few lines of code

Open-Source Libraries: Pre-written code is readily available, with algorithms at your disposal, so you do not have to start every project from scratch. You can benefit from highly specific libraries – physics, web development, gaming, machine learning – by simply importing algorithms and applying them to your own data. It is plug and play at its best, with new functionalities being added all the time

Community Exchanges: Python’s popularity means it has great community support, with almost 8 million Python developers across the world to help you debug or resolve a programming challenge

Compatibility: Python is a cross-platform language and can be integrated easily with Windows and other platforms

Adaptability: Almost every field is adopting Python and needs both generalists and specialists who know how to use it. Fields as varied as gaming, web development, healthcare, and fintech prefer Python over other programming languages, making it the must-learn language for STEM professionals and data scientists

Who this course is for:

- This course, "Python for Corporate Finance and Investment Analysis," is tailored for a diverse range of participants who share an interest in integrating Python programming skills with financial analysis and investment strategies. The target audience includes:

- Finance Professionals: Individuals working in corporate finance, investment banking, portfolio management, risk management, and financial planning who want to enhance their analytical skills and embrace automation and data-driven decision-making in their workflows.

- Business Analysts and Consultants: Professionals in business analysis and consulting roles who seek to deepen their analytical capabilities and provide more sophisticated insights into financial performance, market trends, and investment opportunities.

- Students and Academics in Finance and Economics: University students and academic researchers in finance, economics, business administration, and related fields who aim to supplement their theoretical knowledge with practical, hands-on experience in Python for data analysis and financial modeling.

- Investment Enthusiasts and Individual Traders: Individuals managing their investments or interested in stock market trading, who want to learn how to use Python for investment analysis, portfolio optimization, and developing algorithmic trading strategies.

- Career Changers and Lifelong Learners: Professionals from non-finance backgrounds aspiring to transition into finance or investment roles, or those who are interested in personal development and acquiring new, marketable skills at the intersection of finance and technology.

- Technology Professionals Seeking Finance Domain Knowledge: IT and tech professionals, including software developers, who are looking to diversify their skillset by gaining knowledge in financial analysis and investment strategies.

- This course is designed to be accessible to those new to programming while still being challenging enough for those with some experience in Python. It offers a unique blend of financial theory and practical application, making it suitable for anyone looking to enhance their skill set at the nexus of finance and technology.

User Reviews

Rating

John Cousins

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 56

- duration 6:36:32

- Release Date 2024/04/23