About Algorithmic TradingLearn More

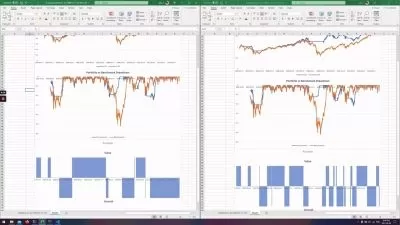

Algorithmic trading uses computer programs to trade stocks and other financial assets automatically at high speeds. By responding to variables such as price points, volume, and market behaviors, trading algorithms reduce the risk of trading too soon or too late based on emotion. Udemy offers a wide selection of algorithmic trading courses to help you understand this potentially lucrative process.

Sort by:

Sorting

The newest

Most visited

Course time

Subtitle

Filtering

Courses

Udemy

ADEBISI kehinde

HARMONIC PATTERNS ALGO-TRADING WITH PYTHON AND BINANCE&BYBIT 28:25:57

04/24/2024

Subtitle

Udemy

Saad T. Hameed (STH) • 0.33+ Million Enrollments Worldwide

Algorithmic Trading Robots Without Programming (17 Hrs) MT5 17:09:34

English subtitles

04/15/2024

Udemy

Hudson and Thames Quantitative Research

Advances in Momentum Trading Strategies 5:33:07

03/12/2024

Subtitle

SkillShareQuantitativeAlgorithmic Investing - Learn from a Former Hedge Fund Quant

57:42

English subtitles

02/05/2024

Subtitle

Linkedin Learning

Brandie Nonnecke

Algorithmic Auditing and Continuous Monitoring 1:03:17

English subtitles

11/13/2023

Books

Frequently asked questions about Algorithmic Trading

Each algorithmic trading strategy designed by a computer programmer follows a specific sequence of steps to ensure trades are timed correctly and executed at the best price. Some examples of common algorithmic trading strategies include execution algorithms are “volume-weighted average price (VWAP),” “time-weighted average price (TWAP),” “implementation shortfall” algorithms, and portfolio rebalancing algorithms. In addition, high-frequency trading algorithms, also known as “alpha-generating strategies,” are designed to help traders decide what security to trade and market timing. Remember, they offer only a handful of trading strategies. Computer programmers continue developing more complex and unique trading strategies.

Each algorithmic trading strategy designed by a computer programmer follows a specific sequence of steps to ensure trades are timed correctly and executed at the best price. These strategies fall under three use cases: execution, portfolio rebalancing, and high-frequency trading (HFT). Execution algorithms, such as “volume-weighted average price (VWAP),” “time-weighted average price (TWAP),” “implementation shortfall” are designed to break down large trade orders. The second group, portfolio rebalancing algorithms, is designed to mitigate risk and readjust an investment portfolio based on market conditions. HFT algorithms, also known as “alpha-generating strategies,” are designed to help traders decide what security to trade and market timing. Keep in mind these are only a handful of trading strategies. Computer programmers always develop more complex and unique trading strategies.

Both retail and institutional traders at financial companies around the world use algorithmic trading every single day. In addition, algorithmic trading is used by investment banks and hedge funds, and mutual funds. Data scientists and computer programmers focus on creating these algorithms. Today, the job profile for algorithmic traders has changed. Data science and data engineering skills have become much more relevant; data scientists and computer programmers focus on creating new trading algorithms. In addition, retail traders can use their existing infrastructure at home or work—a desktop computer, internet connection, and virtual server—to trade using algorithms.

High-frequency trading (HFT) is a type of algorithmic trading characterized by high-speed trade execution, an extremely high number of transactions, and a very short-term investment horizon. The “high-frequency” in this type of trading refers to the tracking of high-frequency streams of data, identifying patterns and trading opportunities in the data, making trading decisions based on those patterns, and automatically placing and executing orders to capitalize on those opportunities. Traders use an automated trading platform supported by powerful computers to transact large orders at the highest speeds possible. HFT strategies work independently from general market trends. More specifically, traders take long and short positions to benefit from temporal mispricing in the markets. HFT is very complex and, therefore, primarily a tool employed by large institutional investors such as investment banks and hedge funds.

Most computer programmers who develop new trading algorithms use the programming languages Python or C++. Python and C++ are general-purpose, object-oriented, high-level programming languages. If you work in finance or are pursuing a career in web development or data science, mastering Python and/pr C++ should be a priority. Day traders can benefit from learning how to create trading software with Python and run it in real-time on a virtual server. MetaQuotes Language 4, also known as MQL4, is a programming language specifically for developing, testing, and optimizing your algorithmic trading systems. For traders interested in learning how to create their algorithms, Udemy offers courses designed to help you quickly master both programming languages.

Aspiring and seasoned traders should cultivate various critical skills if interested in algorithmic trading. First and foremost, traders should have some fundamental math skills and be comfortable using a computer. Learning a programming language such as Python or C++ is one of the most valuable skills you can acquire for developing trading algorithms. New algorithmic traders should also understand how to read and interpret market data. Finally, diligently learn technical analysis, which focuses on historical price movement, analyzing current market conditions, and identifying potential market changes.

In the Greek language, delta is the fourth letter of the alphabet. In mathematical calculations, it means “difference” or “change.” Anyone who would like to create additional income from the financial markets using algorithmic trading should develop a solid understanding of delta. In options trading, delta (also known as one of “The Greeks”) refers to the relationship between an underlying asset’s share price and an option’s share value. In the trading community, delta measures risk and price changes in options trading. The delta of an option measures the risk versus the reward of a potential trade. Understanding delta can be critical for novices learning to create algorithms to trade options, as it helps determine the best price.

Mastering algorithmic trading requires time and discipline, but you might find some concepts easier to learn than others, depending on your background. Beginners with a solid background in math or analytics should be able to understand and apply trading strategies with relative ease. Those with a genuine interest in computer programming may find it easy to develop and use the algorithms. Aspiring traders without those prerequisites will likely spend more time learning all aspects of algorithmic trading, but many novice learners believe its potential as a profitable investment makes it a worthwhile skill to pursue.