Two QuickBooks File-Business & Personal vs One File For Both

Robert (Bob) Steele

13:57:45

Description

Practice problem format comparing two methods to enter business and personal data in QuickBooks Desktop Pro 2019

What You'll Learn?

- How to set up a QuickBooks Desktop Pro 2019 file to track personal financial data

- How to enter personal financial data into QuickBooks Desktop Pro 2019 from a bank statement

- How to use one QuickBooks file to track both personal and business financial data with the use of class tracking

- List and describe the pros and cons of using one QuickBooks file to track personal and business financial data to using two QuickBooks files

- Enter personal balance sheet data into personal QuickBooks Desktop Pro 2019 files including home, auto, and home loan

- Enter credit card data using multiple method into QuickBooks Pro Desktop 2019

- Enter employee W-2 Income into QuickBooks Desktop Pro 2019 using multiple methods

- Enter insurance and other prepaid expenses into QuickBooks Pro Desktop 2019 using multiple methods

Who is this for?

What You Need to Know?

More details

DescriptionQuickBooks Pro Desktop 2019, comparing two methods of tracking both business and personal records, one using two QuickBooks Desktop 2019 files, and one using a sing file to track both business and personal financial data using QuickBooks class tracking feature.

We will work with hands-on practical practice problems together under both methods, compare the results, and discuss the pros and cons of each approach.

The course will start with the method of using two separate QuickBooks files for business and personal records because this is the most widely recommended method and provides the greatest separation of business and personal data which is usually a good thing.

We will create new QuickBooks files for both business and personal records. The course will also provide backup files that can be used to jump forward in the course or to rework problems while using the same data set.

We will enter two months of data into our QuickBooks files using simulated bank statements we will provide in the course as PDF files. After we enter the data into QuickBooks, we will generate reports and compare the data in the personal and business files.

The next step will be to enter similar data into one QuickBooks file, a QuickBooks file that will be used to track both personal and business accounting data. To achieve this goal, we will start a new QuickBooks file and enter financial data from a simulated bank statement the course will provide in PDF format.

As we enter data into the joint QuickBooks file, we will assign a class to each transaction that will help to separate the data during financial reporting. After we have entered the data, we will generate reports including a profit and loss by class. The profit and loss by class report well separate business and personal expenses. We will also discuss other options for filtering reports by class.

We will then compare the two methods, the use of two separate QuickBooks files to the use of one QuickBooks file for both business and personal data, separating the content with the use of class tracking.

Next, we will discuss personal balance sheet items and how we can add them to our financial data including financial investments, our home, our mortgage, and our auto.

We will also discuss alternative methods for tracking credit cards, recording loan payments, and entering employee W-2 income. Â

In addition to the instructional videos, this course will include downloadable Â

•   QuickBooks Pro Desktop 2019 Backup files

•   Excel practice files

•   Downloadable PDF Files Â

The QuickBooks Desktop 2019 backup files are a great tool that allows us to jump ahead in the material or to rework material if we choose.

Excel practice files will be preformatted and will generally have at least two tabs, one tab with the completed work and a second tab with a preformatted worksheet we can fill in as we watch the instructional videos.  Â

Who this course is for:

- Business owners looking for the best QuickBooks system for them.

- Bookkeepers looking to differentiate themselves from the competition by learning how to use QuickBooks to track personal finances and use the class tracking feature.

- Accounting students leaning how to apply accounting concepts to practice.

QuickBooks Pro Desktop 2019, comparing two methods of tracking both business and personal records, one using two QuickBooks Desktop 2019 files, and one using a sing file to track both business and personal financial data using QuickBooks class tracking feature.

We will work with hands-on practical practice problems together under both methods, compare the results, and discuss the pros and cons of each approach.

The course will start with the method of using two separate QuickBooks files for business and personal records because this is the most widely recommended method and provides the greatest separation of business and personal data which is usually a good thing.

We will create new QuickBooks files for both business and personal records. The course will also provide backup files that can be used to jump forward in the course or to rework problems while using the same data set.

We will enter two months of data into our QuickBooks files using simulated bank statements we will provide in the course as PDF files. After we enter the data into QuickBooks, we will generate reports and compare the data in the personal and business files.

The next step will be to enter similar data into one QuickBooks file, a QuickBooks file that will be used to track both personal and business accounting data. To achieve this goal, we will start a new QuickBooks file and enter financial data from a simulated bank statement the course will provide in PDF format.

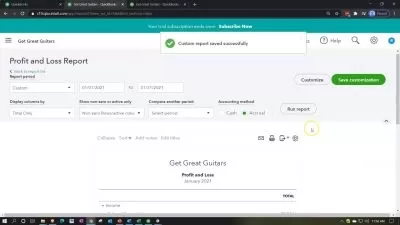

As we enter data into the joint QuickBooks file, we will assign a class to each transaction that will help to separate the data during financial reporting. After we have entered the data, we will generate reports including a profit and loss by class. The profit and loss by class report well separate business and personal expenses. We will also discuss other options for filtering reports by class.

We will then compare the two methods, the use of two separate QuickBooks files to the use of one QuickBooks file for both business and personal data, separating the content with the use of class tracking.

Next, we will discuss personal balance sheet items and how we can add them to our financial data including financial investments, our home, our mortgage, and our auto.

We will also discuss alternative methods for tracking credit cards, recording loan payments, and entering employee W-2 income. Â

In addition to the instructional videos, this course will include downloadable Â

•   QuickBooks Pro Desktop 2019 Backup files

•   Excel practice files

•   Downloadable PDF Files Â

The QuickBooks Desktop 2019 backup files are a great tool that allows us to jump ahead in the material or to rework material if we choose.

Excel practice files will be preformatted and will generally have at least two tabs, one tab with the completed work and a second tab with a preformatted worksheet we can fill in as we watch the instructional videos.  Â

Who this course is for:

- Business owners looking for the best QuickBooks system for them.

- Bookkeepers looking to differentiate themselves from the competition by learning how to use QuickBooks to track personal finances and use the class tracking feature.

- Accounting students leaning how to apply accounting concepts to practice.

User Reviews

Rating

Robert (Bob) Steele

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 144

- duration 13:57:45

- Release Date 2024/05/13