The Risk Management Framework easily explained

Eslam Eldakrory

3:50:08

Description

All what you need to know about the Risk Management Framework and how to build a robust framework for your organization

What You'll Learn?

- Understanding key terms and definitions: including Risk Taxonomy, Risk Appetite, Risk/Reward, Risk Tolerance and many other terms essential in your risk vocab.

- Understanding the key types of risk including: Credit risk, Market risk, operational risk, liquidity risk and Reputational risk

- Understanding what is an Enterprise Risk Management Framework and how it should look like in your organization

- Deep dive in what an effective Risk Management Program should include key practices and how to effectively establish those practices in your organization

- Understanding the key components of a robust Enterprise Risk Management Framework

- Understanding what a Risk Culture means and how that supports the effectiveness of an ERM model

- Understanding how a robust risk culture should look like to nurture an effective risk practices in the organization

- Breakdown the Risk management process from: Risk Identification, Risk Evaluation and Assessment, Risk Response, Risk Monitoring and Reporting

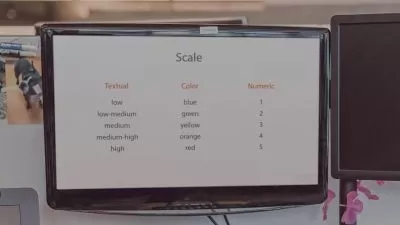

- understanding how to assess risks using the Probability (frequency) and Impact matrix

- Understanding how to monitor risk and the key tools and templates you can use for that

- Gain in-depth understanding of how to assess the effectiveness of existing controls and how to design effective ones (detective, preventive & reactive controls)

- Gain in-depth understanding of the operational risk framework and how to apply that to your organization

- Understanding what controls are and their role in reducing risk rating

Who is this for?

More details

DescriptionHello and welcome to one of the top and highest-rated Risk Management courses on the platform.

Since you made it to this page, I'm sure you are seeking to master the operational risk management framework and help your organization in building a robust framework that truly works in identifying, assessing, analyzing, managing, and monitoring both existing and emerging risk.

Throughout this course, I will take you from the very beginning and introductory level to the risk management concept all the way to mastering the risk assessment, evaluation, response, and monitoring and reporting procedures

You'll go through over 2 hrs of best-in-class Risk Management resources that will not only develop a high in-demand skill nowadays but also will enable you to help your organization effectively understand and analyze risks and also will advance your skill set to progress your career further.

This is a comprehensive program and I have split it into 7 modules:

Module 1: introductory level

In this module, you will learn the following:

History of operational risk.

Course outline and agenda

I'll also give you some practical tips on how to get the best out of any learning experience that you can apply in any learning process to increase information absorption and retention on the long run.

Module 2: Risk Management 101

In this module, you will learn the following:

The Risk Management framework:

Risk

Risk and reward

examples

Risk Appetite

Most common types of risk:

Market Risk

Credit Risk,

Operational Risk

Liquidity Risk

Strategic Risk

ESG Risk

Module 3: Risk Management Framework (introduction)

In this module, you will learn the following:

The Risk Management framework's main components:

Risk Culture (what is risk culture and how it affects risk management effectiveness)

The Enterprise Risk management program

The Enterprise Risk Management Program:

In this section, you will learn the following:

Introduction to the holistic approach to a robust Risk management program and its key components of it.

Risk Identification: how to identify existing and potential risks

Risk Analysis: how to analyze and understand how certain risks can represent different levels of threat to your organization.

Risk Evaluation: the practical and scientific approach to objectively assess the severity of risk using the Impact and Likelihood matrix of a certain risk on your organization

Risk Controls: What is control and how do they impact your inherent and residual risk assessment?

Control Assessment: How to determine the types of control (Preventive, Detective, Directive) and How to assess the control effectiveness?

Risk Response: how to prioritize risks and what are the different approaches to respond to each of the identified risks according to their residual impact and the organization's Risk Tolerance and Appetite?

Risk Response strategies: understanding various risk mitigation strategies and how and when to implement them including Risk sharing, Risk reduction/control, Risk avoidance, and Risk Transfer

Risk Monitoring and Reporting: How Risk Monitoring is critical to the risk management process and the importance of risk reporting and what are the key risk management reports Executive Management and the Board need to see to better understand the organization's risk profile.

Understanding the Risk Governance framework

Key Risk Management Monitoring and Reporting programs

In this section, you will learn the following:

How to establish the Risk And Control Self-Assessment -RCSA monitoring report

How to establish the Operational Risk Loss Event -ORLE report

How to establish the Key Risk Indicators -KRIs dashboard

How to establish an enterprise-wide Risk profile metric -Risk Heatmap profile

Risk Assessment:

In this section, you will learn the following:

• You will learn about the Most Common Disruption Events an Organization has to plan for

• You will learn the 3 key steps in the risk management lifecycle

• You will learn about the risk Impact and probability matrix

• You will learn the process of risk identification

• You will learn how to perform Risk Analysis

• You will learn how to evaluate risks and how to determine the magnitude of the impact from different aspects.

A robust risk management process is the key to organizational resilience, growth, and survival, And that is your role to master in your organization.

Who this course is for:

- Young professionals looking to join the Operational Risk field

- Senior professionals looking to join the Enterprise and Operational Risk field

- Operational Risk officers at any level in their career

- Risk professionals looking to take the next step in their career path

- Enterprise Risk Management tutors, mentors and educators looking to expand their knowledge

- Professionals looking to join the Risk consulting and advisory field

Hello and welcome to one of the top and highest-rated Risk Management courses on the platform.

Since you made it to this page, I'm sure you are seeking to master the operational risk management framework and help your organization in building a robust framework that truly works in identifying, assessing, analyzing, managing, and monitoring both existing and emerging risk.

Throughout this course, I will take you from the very beginning and introductory level to the risk management concept all the way to mastering the risk assessment, evaluation, response, and monitoring and reporting procedures

You'll go through over 2 hrs of best-in-class Risk Management resources that will not only develop a high in-demand skill nowadays but also will enable you to help your organization effectively understand and analyze risks and also will advance your skill set to progress your career further.

This is a comprehensive program and I have split it into 7 modules:

Module 1: introductory level

In this module, you will learn the following:

History of operational risk.

Course outline and agenda

I'll also give you some practical tips on how to get the best out of any learning experience that you can apply in any learning process to increase information absorption and retention on the long run.

Module 2: Risk Management 101

In this module, you will learn the following:

The Risk Management framework:

Risk

Risk and reward

examples

Risk Appetite

Most common types of risk:

Market Risk

Credit Risk,

Operational Risk

Liquidity Risk

Strategic Risk

ESG Risk

Module 3: Risk Management Framework (introduction)

In this module, you will learn the following:

The Risk Management framework's main components:

Risk Culture (what is risk culture and how it affects risk management effectiveness)

The Enterprise Risk management program

The Enterprise Risk Management Program:

In this section, you will learn the following:

Introduction to the holistic approach to a robust Risk management program and its key components of it.

Risk Identification: how to identify existing and potential risks

Risk Analysis: how to analyze and understand how certain risks can represent different levels of threat to your organization.

Risk Evaluation: the practical and scientific approach to objectively assess the severity of risk using the Impact and Likelihood matrix of a certain risk on your organization

Risk Controls: What is control and how do they impact your inherent and residual risk assessment?

Control Assessment: How to determine the types of control (Preventive, Detective, Directive) and How to assess the control effectiveness?

Risk Response: how to prioritize risks and what are the different approaches to respond to each of the identified risks according to their residual impact and the organization's Risk Tolerance and Appetite?

Risk Response strategies: understanding various risk mitigation strategies and how and when to implement them including Risk sharing, Risk reduction/control, Risk avoidance, and Risk Transfer

Risk Monitoring and Reporting: How Risk Monitoring is critical to the risk management process and the importance of risk reporting and what are the key risk management reports Executive Management and the Board need to see to better understand the organization's risk profile.

Understanding the Risk Governance framework

Key Risk Management Monitoring and Reporting programs

In this section, you will learn the following:

How to establish the Risk And Control Self-Assessment -RCSA monitoring report

How to establish the Operational Risk Loss Event -ORLE report

How to establish the Key Risk Indicators -KRIs dashboard

How to establish an enterprise-wide Risk profile metric -Risk Heatmap profile

Risk Assessment:

In this section, you will learn the following:

• You will learn about the Most Common Disruption Events an Organization has to plan for

• You will learn the 3 key steps in the risk management lifecycle

• You will learn about the risk Impact and probability matrix

• You will learn the process of risk identification

• You will learn how to perform Risk Analysis

• You will learn how to evaluate risks and how to determine the magnitude of the impact from different aspects.

A robust risk management process is the key to organizational resilience, growth, and survival, And that is your role to master in your organization.

Who this course is for:

- Young professionals looking to join the Operational Risk field

- Senior professionals looking to join the Enterprise and Operational Risk field

- Operational Risk officers at any level in their career

- Risk professionals looking to take the next step in their career path

- Enterprise Risk Management tutors, mentors and educators looking to expand their knowledge

- Professionals looking to join the Risk consulting and advisory field

User Reviews

Rating

Eslam Eldakrory

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 25

- duration 3:50:08

- Release Date 2023/01/31