The Real Estate Equity Waterfall Modeling Master Class

Justin Kivel

3:45:09

Description

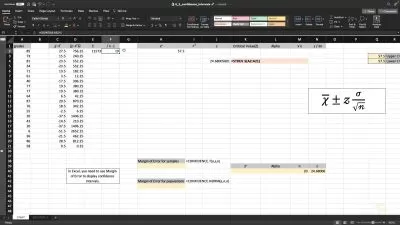

The Complete Guide To Building Dynamic Real Estate Equity Waterfall Models In Microsoft Excel

What You'll Learn?

- A complete "done-for-you" institutional-level equity waterfall model to use in any real estate transaction.

- A thorough understanding of the key components of an equity waterfall and how it is used in real estate investing.

- The ability to build a fully functioning, dynamic equity waterfall model in Microsoft Excel to use for any deal in any situation.

Who is this for?

What You Need to Know?

More details

DescriptionEverything you need to know about real estate equity waterfalls, all in one place.Â

This course will teach you everything need to know about how an equity waterfall works in real estate transactions, from the underlying mechanisms behind a waterfall, to how an equity waterfall is structured, to how to build an equity waterfall financial model in Excel. Whether you're syndicating a real estate deal on your own, investing as a Limited Partner in a real estate syndication, or you're a current real estate professional looking to add a lucrative skill set to your arsenal, this is a one-stop shop for everything real estate equity waterfall-related.

This course was designed for people from all parts of the real estate spectrum, including:

Current or aspiring real estate syndicators who want to earn outsize returns on their investments - Being aligned with investor interests is critical when structuring a real estate transaction, and a clear waterfall structure with incentives based on investment performance is the most direct way to create a win-win relationship for your team and your capital partners. Understanding the mechanisms behind an equity waterfall and having a dynamic waterfall model in your toolkit will allow you to structure your deals in the most advantageous way for both yourself and your investors.

Passive real estate investors involved as LPs in real estate syndications who want to invest passively with confidence - The Limited Partner position in real estate investing is a great role - no work involved, an inflation-protected, tax-shielded investment, and experienced management - but do you know how much you're paying in fees? Understanding how a waterfall structure functions and having a dynamic Excel model to calculate true net returns can be the difference between a sound investment and being locked into a watered-down deal for years to come.

Current real estate professionals who want to earn more money - Equity waterfall modeling is one of the most desired skill-sets in all of real estate finance, with professionals proficient in this topic earning more than 8.1% above their peers according to national real estate recruiting firm RETS Associates. If you are a current or aspiring real estate professional, understanding the mechanics of an equity waterfall functions and how to build an equity waterfall in Microsoft Excel will put you head and shoulders ahead of your peers and add a rare and lucrative skill-set to your real estate investing arsenal.

Here's what some of our students have had to say:

★★★★★ "I've tried other real estate financial modeling classes, and they tended to be too general (even where they had some hands-on Excel exercises). Justin hit just the right balance between the big picture and the nuts and bolts of building the worksheet, and, therefore, truly understanding it."

★★★★★"Clear and straightforward. Wow! Amazed at this curriculum. He has made something super difficult easy and he explains it super clear. Its like meeting a super cool private equity guy spend the time to show you step by step. He can make your career!"

★★★★★"This course is highly recommended for individuals wanting to learn about equity waterfall modeling. It's obvious that the instructor understands this topic very well and he presents it in a very simplified manner. The process of creating the model from scratch and having the instructor walk you through it on a step-by-step basis really solidified my understanding of this material. Excellent course!"

★★★★★"Highly detailed and informative. Great for analyst who are just getting started. It's like taking an MBA level course!"

★★★★★"This is a phenomenal course as are Justin's other courses. I am a commercial real estate professional working as an analyst at a 'Big Four' broker and have found all these courses to be invaluable, particularly if you are concerned about the technical test for job interviews."

Understanding equity waterfalls will put you miles ahead of the game, whether you're looking to do your first deal or trying to land a job in commercial real estate finance. Looking forward to seeing you in the course!

Who this course is for:

- Real estate investors and syndicators who want to learn how to build an equity waterfall model from scratch.

- Real estate private equity analysts and associates who want to add another valuable and lucrative skill set to their arsenal.

Everything you need to know about real estate equity waterfalls, all in one place.Â

This course will teach you everything need to know about how an equity waterfall works in real estate transactions, from the underlying mechanisms behind a waterfall, to how an equity waterfall is structured, to how to build an equity waterfall financial model in Excel. Whether you're syndicating a real estate deal on your own, investing as a Limited Partner in a real estate syndication, or you're a current real estate professional looking to add a lucrative skill set to your arsenal, this is a one-stop shop for everything real estate equity waterfall-related.

This course was designed for people from all parts of the real estate spectrum, including:

Current or aspiring real estate syndicators who want to earn outsize returns on their investments - Being aligned with investor interests is critical when structuring a real estate transaction, and a clear waterfall structure with incentives based on investment performance is the most direct way to create a win-win relationship for your team and your capital partners. Understanding the mechanisms behind an equity waterfall and having a dynamic waterfall model in your toolkit will allow you to structure your deals in the most advantageous way for both yourself and your investors.

Passive real estate investors involved as LPs in real estate syndications who want to invest passively with confidence - The Limited Partner position in real estate investing is a great role - no work involved, an inflation-protected, tax-shielded investment, and experienced management - but do you know how much you're paying in fees? Understanding how a waterfall structure functions and having a dynamic Excel model to calculate true net returns can be the difference between a sound investment and being locked into a watered-down deal for years to come.

Current real estate professionals who want to earn more money - Equity waterfall modeling is one of the most desired skill-sets in all of real estate finance, with professionals proficient in this topic earning more than 8.1% above their peers according to national real estate recruiting firm RETS Associates. If you are a current or aspiring real estate professional, understanding the mechanics of an equity waterfall functions and how to build an equity waterfall in Microsoft Excel will put you head and shoulders ahead of your peers and add a rare and lucrative skill-set to your real estate investing arsenal.

Here's what some of our students have had to say:

★★★★★ "I've tried other real estate financial modeling classes, and they tended to be too general (even where they had some hands-on Excel exercises). Justin hit just the right balance between the big picture and the nuts and bolts of building the worksheet, and, therefore, truly understanding it."

★★★★★"Clear and straightforward. Wow! Amazed at this curriculum. He has made something super difficult easy and he explains it super clear. Its like meeting a super cool private equity guy spend the time to show you step by step. He can make your career!"

★★★★★"This course is highly recommended for individuals wanting to learn about equity waterfall modeling. It's obvious that the instructor understands this topic very well and he presents it in a very simplified manner. The process of creating the model from scratch and having the instructor walk you through it on a step-by-step basis really solidified my understanding of this material. Excellent course!"

★★★★★"Highly detailed and informative. Great for analyst who are just getting started. It's like taking an MBA level course!"

★★★★★"This is a phenomenal course as are Justin's other courses. I am a commercial real estate professional working as an analyst at a 'Big Four' broker and have found all these courses to be invaluable, particularly if you are concerned about the technical test for job interviews."

Understanding equity waterfalls will put you miles ahead of the game, whether you're looking to do your first deal or trying to land a job in commercial real estate finance. Looking forward to seeing you in the course!

Who this course is for:

- Real estate investors and syndicators who want to learn how to build an equity waterfall model from scratch.

- Real estate private equity analysts and associates who want to add another valuable and lucrative skill set to their arsenal.

User Reviews

Rating

Justin Kivel

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 45

- duration 3:45:09

- English subtitles has

- Release Date 2024/06/14