Real Estate Investing Partnerships, Agreements & Structure

Kevin Prociw

1:24:06

Description

Pt. 1 dives into commercial real estate development LLC structures, fees, equity, operating agreements, + so much more.

What You'll Learn?

- How partnerships are set up, LLC structures with funds and individual investors, how equity flows plus some concepts to help you avoid making mistakes.

- Operating agreements, term sheets and critical items to address like fees, equity splits and how decisions are made within a partnership

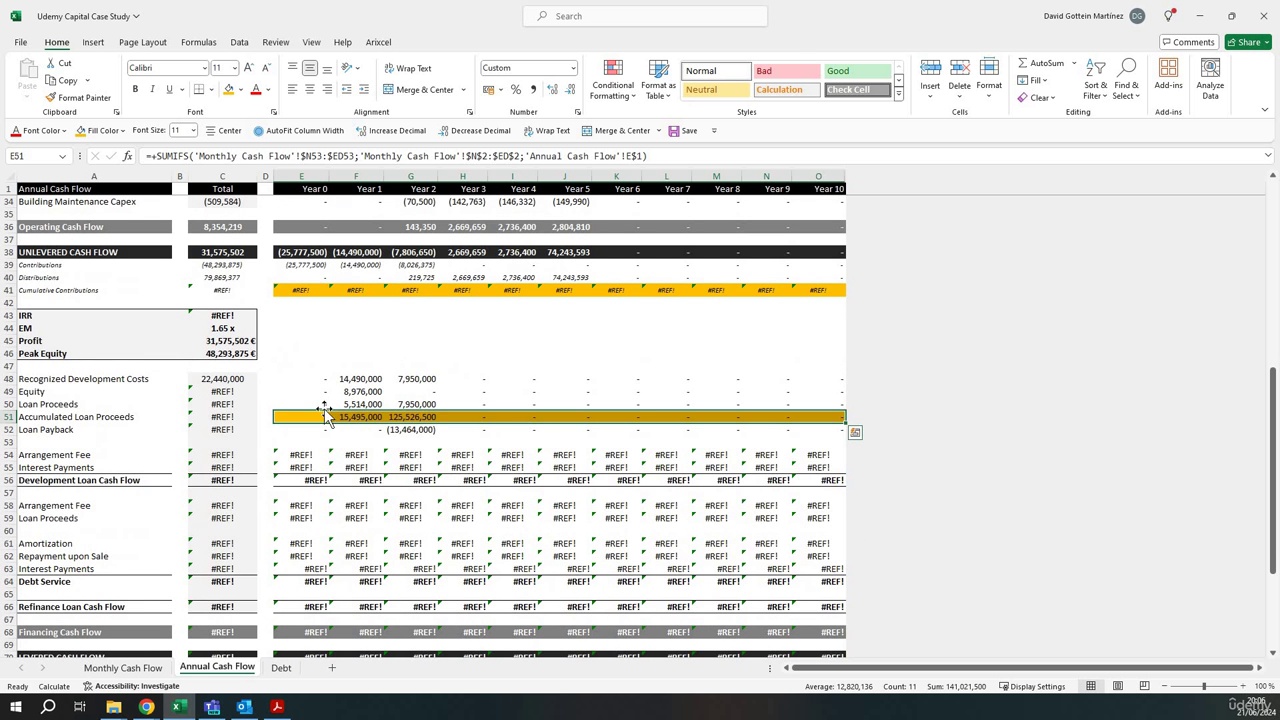

- Real estate development banking and LLC structures - how to make banking simple for your partnership and how capital actually flows between entities.

- Marketing your deal, what to include so your pitch deck is simple and efficient plus where to find investors (other than friends and family)

Who is this for?

More details

DescriptionGet detailed "how-to's" that show you precisely what needs to be done so you can talk the talk, grow your career and get deals done successfully. You'll learn from actual contracts, agreements, construction plans, and forms so you can be confident working with architects, engineers, lawyers, funds and other advanced real estate pros and investors.

"I have spent thousands of dollars on classes and seminars that wasted my time and money without teaching me anything new..."

This course was designed to be the opposite of that.

Walk through the beginning aspects of a mock development so you can see how to analyze deals from brokers, perform initial due diligence, and see how a development concept comes together. Learn what private equity firms and investors want to see in your pitch deck to get interest from big-money funds and investors.

Then dive deep into LLC structures, what to expect in term sheets and how partnership operating agreements come together. Learn what fees you can expect and how to start getting money in the door, plus so much more...

What you'll learn...

Where to find deals, what to look for in initial due diligence and creating pitch decks for your development

Finding demographics (that are relevant)

Partnership layouts and how LLC's are structured

How equity flows and where it comes from

Term sheets, business structures, and deal points

Operating agreements - what fees to include and terms to expect and negotiate

Where banks fit in and potential problems to avoid with your LLC's and structures

Finding investors for your deal

Who this course is for:

- Imagine following a developer for a day, seeing how they make decisions, learning how they negotiate, structure deals, and find properties that grow their business. Get insights on how the business actually works and learn advanced topics in a simple format. Part 1 of this series covers how partnerships are formed, fees, putting together deal pitch decks and so much more.

Get detailed "how-to's" that show you precisely what needs to be done so you can talk the talk, grow your career and get deals done successfully. You'll learn from actual contracts, agreements, construction plans, and forms so you can be confident working with architects, engineers, lawyers, funds and other advanced real estate pros and investors.

"I have spent thousands of dollars on classes and seminars that wasted my time and money without teaching me anything new..."

This course was designed to be the opposite of that.

Walk through the beginning aspects of a mock development so you can see how to analyze deals from brokers, perform initial due diligence, and see how a development concept comes together. Learn what private equity firms and investors want to see in your pitch deck to get interest from big-money funds and investors.

Then dive deep into LLC structures, what to expect in term sheets and how partnership operating agreements come together. Learn what fees you can expect and how to start getting money in the door, plus so much more...

What you'll learn...

Where to find deals, what to look for in initial due diligence and creating pitch decks for your development

Finding demographics (that are relevant)

Partnership layouts and how LLC's are structured

How equity flows and where it comes from

Term sheets, business structures, and deal points

Operating agreements - what fees to include and terms to expect and negotiate

Where banks fit in and potential problems to avoid with your LLC's and structures

Finding investors for your deal

Who this course is for:

- Imagine following a developer for a day, seeing how they make decisions, learning how they negotiate, structure deals, and find properties that grow their business. Get insights on how the business actually works and learn advanced topics in a simple format. Part 1 of this series covers how partnerships are formed, fees, putting together deal pitch decks and so much more.

User Reviews

Rating

Kevin Prociw

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 5

- duration 1:24:06

- Release Date 2023/03/16