QuickBooks Online Payments – Getting Paid Faster & Easier

Robert (Bob) Steele

5:39:07

Description

Streamlining Invoicing, Mastering Payment Tracking, Unraveling Bank Feeds, Automating Recurring Bills & More

What You'll Learn?

- Demonstrate QuickBooks Payments Setup: Showcase your ability to activate and configure QuickBooks Online Payments effectively.

- Construct Professional Invoices: Develop and distribute accurate invoices directly to your clients efficiently.

- Analyze Payment Grouping: Assess how QuickBooks Online Payments groups received payments for bank deposit.

- Evaluate Customer Payments and Bank Feeds: Understand the relationship between customer payments and bank feeds for accurate records.

- Design Recurring Invoices & Receipts: Learn to create and schedule regular invoices and sales receipts, saving valuable time.

- Apply Navigation Skills: Implement learned techniques to efficiently navigate and utilize QuickBooks Online Payments.

- Synthesize Financial Management Practices: Combine expert tips to streamline your financial management and bookkeeping process.

Who is this for?

What You Need to Know?

More details

DescriptionThis is a comprehensive course designed specifically for bookkeepers, small business owners, and freelancers who want to streamline their invoicing and payment systems.

QuickBooks Online Payments offers a fast and reliable way to send invoices, receive payments, and manage your business financials with a click of a button. However, without proper knowledge, you might not be utilizing this tool to its full potential.

This course aims to bridge that gap. It is structured to teach you how to fully optimize the QuickBooks Online Payments tool and revolutionize your business financials. The course will guide you on how to:

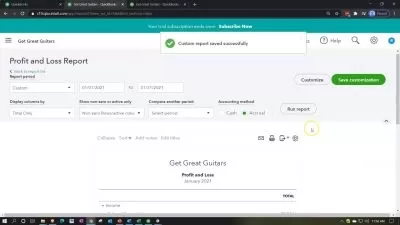

1. Activate and Configure QuickBooks Online Payments: We start from the basics - turning on QuickBooks Payments. A step-by-step tutorial to help you get started with the tool.

2. Create and Send Invoices: Learn how to create professional invoices and send them directly to your clients. See firsthand what your customer’s email will look like.

3. Track Payments: Gain insights into how to effectively monitor incoming payments. We will focus on how the payments will be grouped together to match the deposit in your bank account.

4. Understand Customer Payments and Bank Feeds: Explore the interplay between customer payments and bank feeds, ensuring that your books are always accurate and up-to-date.

5. Create Recurring Invoices and Sales Receipts: Find out how to automate your invoicing and receipt generation process with QuickBooks Payments, freeing up more time for you to focus on other aspects of your business.

The course will use real-life scenarios, practical examples, and clear demonstrations to impart knowledge, ensuring you can apply these skills immediately in your business.

Whether you're a novice in QuickBooks or already have some experience, this course will serve as a helpful guide to optimize your usage of QuickBooks Online Payments. Get ready to simplify your invoicing, enhance your payment tracking, and improve your financial management skills with us!

Sign up now and take the first step towards mastering QuickBooks Online Payments!

Who this course is for:

- Small Business Owners: Who wish to automate their financial management process, improve their invoicing system, and streamline payment collections.

- Bookkeepers and Accountants: Looking to upgrade their skills and become more proficient in using QuickBooks Online Payments for their clients or their own business.

- Freelancers: Who want to effectively manage their finances, automate their invoicing process, and ensure a smooth payment collection from their clients.

- Finance Professionals: Seeking to broaden their skillset with knowledge of QuickBooks Online Payments and improve their career prospects.

- QuickBooks Online Users: Any users of QuickBooks Online who want to fully optimize their usage of the platform, particularly the QuickBooks Online Payments tool.

- Entrepreneurs: Aspiring or established entrepreneurs who are aiming to better manage their finances and improve cash flow.

This is a comprehensive course designed specifically for bookkeepers, small business owners, and freelancers who want to streamline their invoicing and payment systems.

QuickBooks Online Payments offers a fast and reliable way to send invoices, receive payments, and manage your business financials with a click of a button. However, without proper knowledge, you might not be utilizing this tool to its full potential.

This course aims to bridge that gap. It is structured to teach you how to fully optimize the QuickBooks Online Payments tool and revolutionize your business financials. The course will guide you on how to:

1. Activate and Configure QuickBooks Online Payments: We start from the basics - turning on QuickBooks Payments. A step-by-step tutorial to help you get started with the tool.

2. Create and Send Invoices: Learn how to create professional invoices and send them directly to your clients. See firsthand what your customer’s email will look like.

3. Track Payments: Gain insights into how to effectively monitor incoming payments. We will focus on how the payments will be grouped together to match the deposit in your bank account.

4. Understand Customer Payments and Bank Feeds: Explore the interplay between customer payments and bank feeds, ensuring that your books are always accurate and up-to-date.

5. Create Recurring Invoices and Sales Receipts: Find out how to automate your invoicing and receipt generation process with QuickBooks Payments, freeing up more time for you to focus on other aspects of your business.

The course will use real-life scenarios, practical examples, and clear demonstrations to impart knowledge, ensuring you can apply these skills immediately in your business.

Whether you're a novice in QuickBooks or already have some experience, this course will serve as a helpful guide to optimize your usage of QuickBooks Online Payments. Get ready to simplify your invoicing, enhance your payment tracking, and improve your financial management skills with us!

Sign up now and take the first step towards mastering QuickBooks Online Payments!

Who this course is for:

- Small Business Owners: Who wish to automate their financial management process, improve their invoicing system, and streamline payment collections.

- Bookkeepers and Accountants: Looking to upgrade their skills and become more proficient in using QuickBooks Online Payments for their clients or their own business.

- Freelancers: Who want to effectively manage their finances, automate their invoicing process, and ensure a smooth payment collection from their clients.

- Finance Professionals: Seeking to broaden their skillset with knowledge of QuickBooks Online Payments and improve their career prospects.

- QuickBooks Online Users: Any users of QuickBooks Online who want to fully optimize their usage of the platform, particularly the QuickBooks Online Payments tool.

- Entrepreneurs: Aspiring or established entrepreneurs who are aiming to better manage their finances and improve cash flow.

User Reviews

Rating

Robert (Bob) Steele

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 22

- duration 5:39:07

- Release Date 2023/07/22