QuickBooks Online 2021 2 Create New Company File and Enter Data

Focused View

13:59:57

30 View

01-quickbooks online 2021 2 create new company file and enter data.mp4

01:30

02-6.05 quickbooks online comprehensive problem introduction.mp4

08:03

03-6.07 30-day free trial setup.mp4

10:12

04-6.15 account and settings company tab.mp4

07:20

05-6.20 account and settings-billing and subscription usage and sales tabs.mp4

09:17

06-6.25 account and settings-expenses payments and advanced tabs.mp4

16:32

07-6.30 managing users.mp4

12:31

08-6.35 dark mode quickbooks labs.mp4

05:23

09-6.45 beginning balances customers vendors and products and services.mp4

13:01

10-6.50 enter service items.mp4

19:48

11-6.55 inventory tracking options.mp4

12:06

12-6.60 add inventory items and opening balance.mp4

22:12

13-6.65 setup sales tax.mp4

14:51

14-6.70 accounts receivable beginning balance and new customers.mp4

23:00

15-6.75 accounts payable beginning balance and new vendors.mp4

12:45

16-6.80 opening balances and add accounts to chart of accounts.mp4

25:38

17-6.85 adjust opening balance equity accounts.mp4

12:34

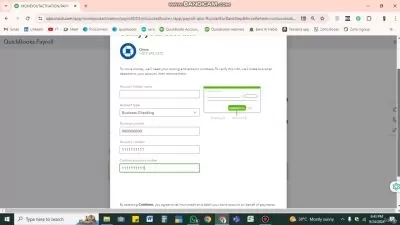

18-6.87 payroll setup.mp4

16:39

19-7.05 deposits from owner and loan.mp4

15:22

20-7.10 purchase depreciable asset and make investment in securities.mp4

20:48

21-7.13 check entry correction.mp4

06:19

22-7.17 enter purchase order p.o..mp4

12:56

23-7.18 use purchase order to make check or expense form.mp4

19:23

24-7.20 create invoice sale of inventory item.mp4

18:39

25-7.25 receive payment on invoices.mp4

17:46

26-7.30 sales receipt payment received at point of sale.mp4

17:20

27-7.35 deposit from sales receipt and receive payment forms.mp4

12:18

28-7.45 invoices created from check created from p.o..mp4

17:54

29-7.50 receive payment and make deposit.mp4

13:47

30-7.55 write checks for expenses and prepaid assets.mp4

25:44

31-7.60 pay bill form.mp4

10:01

32-7.65 job sub customer and project.mp4

14:10

33-7.70 pay employees.mp4

23:05

34-7.77 correct a sales receipt.mp4

05:58

35-7.80 generate reports after one month of data input.mp4

21:45

36-8.05 make loan amortization table.mp4

19:40

37-8.07 make loan payments using an amortization table.mp4

15:37

38-8.10 short-term investment sale record gain or loss.mp4

15:04

39-8.15 purchase order and new inventory item.mp4

07:42

40-8.20 receipt of inventory create bill from purchase order.mp4

10:21

41-8.25 record sales receipt and make deposit.mp4

11:15

42-8.30 advanced customer deposit payment.mp4

14:46

43-8.35 apply customer deposit (credit) to invoice.mp4

11:55

44-8.40 populate invoice from billable item on bill form.mp4

11:08

45-8.45 customer prepayment unearned revenue two methods.mp4

17:32

46-8.50 pay bill that was created from p.o..mp4

08:57

47-8.55 track and pay invoices from customer center.mp4

13:01

48-8.60 pay sales tax.mp4

12:32

49-8.65 pay payroll tax.mp4

18:13

50-8.70 bills-enter sort and pay.mp4

20:42

51-8.75 add service items and enter invoices in service job cost system.mp4

17:40

52-8.77 rental income-customer deposit invoice and payment.mp4

22:40

53-8.79 purchase and finance equipment add sub-accounts.mp4

20:00

54-8.80 enter payroll for second month.mp4

26:38

55-8.86 create reports after second month including comparative financial statements.mp4

27:57

More details

User Reviews

Rating

average 0

Focused display

Category

SkillShare

View courses SkillShareSkillshare is an online learning community based in the United States for people who want to learn from educational videos. The courses, which are not accredited, are only available through paid subscription.

- language english

- Training sessions 55

- duration 13:59:57

- Release Date 2024/03/08