Introduction to Risk Management

Adrian Resag, QIAL, CMIIA, CIA, CISA, CRMA, CFSA, GRCP, CIMA Adv Dip MA

7:29:57

Description

Learn how to manage risks for business success.

What You'll Learn?

- The basics (and intermediate knowledge) of operational risk management.

- Understand the role of Risk Management in the management of an organization’s risks.

- How to put in place Enterprise Risk Management (ERM) in your organization.

- Risk Management tools and techniques.

- Learn how to apply governance structures and frameworks over the management of risks in an organization.

- Know how to assess the governance framework in place.

- Know different measures for evaluating risks, how risk and control self-assessments are performed.

- Know how the monitoring of risks and the risk management system should be performed.

- Know how to use risk management maturity models in your organization.

- What you need to know to perform proper audits of risk management.

Who is this for?

What You Need to Know?

More details

DescriptionWe are glad to bring you a course on Risk Management.

This course will help you manage risks so that your business can succeed.

Learn essential business knowledge for anyone who want to manage operations successfully.

This course will give you all that you need to know to get a firm understanding of operational risk management.

It is intended for either:Â

1. Risk Managers and those who want to learn more about risk management.

2. Managers and those who are responsible for operations in their organization.

3. Auditors and others assessing how risks are managed.

It is taught by Adrian Resag, an experienced Head of Risk Management, who has also been teaching for nearly 2 decades.

You will learn:Â

The basics (and intermediate knowledge) of operational risk management.

How to put in place Enterprise Risk Management (ERM) in your organization.

Risk Management tools and techniques.

What you need to know to perform proper audits of risk management.

The course covers:

Introduction to Risk Management

Understand the role of Risk Management in the management of an organization’s risks.

The Governance of Risk Management

Learn how to apply governance structures and frameworks over the management of risks in an organization.

Know how to assess the governance framework in place.

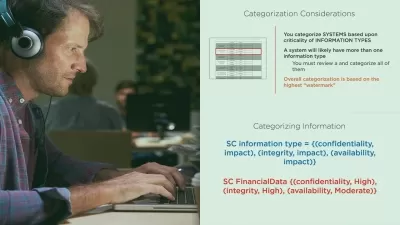

Risk Management Tools and Techniques

Lean about the main risk management frameworks, such as ISOÂ 31000 and COSOÂ ERM.

Learn risk identification and risk evaluation techniques, such as control self-assessment or fault tree analysis.

Learn about using data analytics for risk management.

Learn statistical techniques for risk management.

Learn how to assess risks in the Systems Development Life Cycle (SDLC).

Assurance over Risk Management Learn how to perform risk assessments

Know different measures for evaluating risks, how risk and control self-assessments are performed.

Know how the monitoring of risks and the risk management system should be performed.

Know how to use risk management maturity models in your organization.

Who this course is for:

- This course is useful for a surprisingly large number of people. If you are (or want to be) in charge of operations in a business, knowing how to manage risks is very important.

- For those who want to learn more about risk management.

- For those who want to learn how to audit risk management.

- Risk Managers

- Auditors

- Management

We are glad to bring you a course on Risk Management.

This course will help you manage risks so that your business can succeed.

Learn essential business knowledge for anyone who want to manage operations successfully.

This course will give you all that you need to know to get a firm understanding of operational risk management.

It is intended for either:Â

1. Risk Managers and those who want to learn more about risk management.

2. Managers and those who are responsible for operations in their organization.

3. Auditors and others assessing how risks are managed.

It is taught by Adrian Resag, an experienced Head of Risk Management, who has also been teaching for nearly 2 decades.

You will learn:Â

The basics (and intermediate knowledge) of operational risk management.

How to put in place Enterprise Risk Management (ERM) in your organization.

Risk Management tools and techniques.

What you need to know to perform proper audits of risk management.

The course covers:

Introduction to Risk Management

Understand the role of Risk Management in the management of an organization’s risks.

The Governance of Risk Management

Learn how to apply governance structures and frameworks over the management of risks in an organization.

Know how to assess the governance framework in place.

Risk Management Tools and Techniques

Lean about the main risk management frameworks, such as ISOÂ 31000 and COSOÂ ERM.

Learn risk identification and risk evaluation techniques, such as control self-assessment or fault tree analysis.

Learn about using data analytics for risk management.

Learn statistical techniques for risk management.

Learn how to assess risks in the Systems Development Life Cycle (SDLC).

Assurance over Risk Management Learn how to perform risk assessments

Know different measures for evaluating risks, how risk and control self-assessments are performed.

Know how the monitoring of risks and the risk management system should be performed.

Know how to use risk management maturity models in your organization.

Who this course is for:

- This course is useful for a surprisingly large number of people. If you are (or want to be) in charge of operations in a business, knowing how to manage risks is very important.

- For those who want to learn more about risk management.

- For those who want to learn how to audit risk management.

- Risk Managers

- Auditors

- Management

User Reviews

Rating

Adrian Resag, QIAL, CMIIA, CIA, CISA, CRMA, CFSA, GRCP, CIMA Adv Dip MA

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 112

- duration 7:29:57

- English subtitles has

- Release Date 2023/08/15