IFRS9 Expected Credit Loss Model Development and Validation

Subhashish Ray

4:49:16

Description

Learn how to model and validate expected credit losses for IFRS9 using R Programming

What You'll Learn?

- IFRS9 Expected Credit Loss (ECL) Staging

- Understand the science and logic behind model development

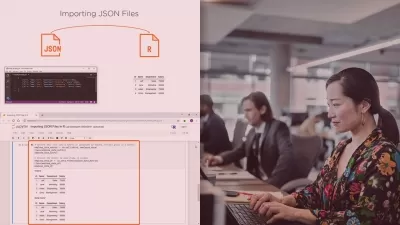

- Building predictive models with R Programming

- Model Validation

- Introduction to PD, LGD and EAD modeling

- R Programming fundamentals for credit risk modeling

Who is this for?

What You Need to Know?

More details

DescriptionThis course will introduce you to the concept of provisioning, background of IFRS9 and the journey to forward looking impairment calculation framework. The staging allocation process is covered in depth before the introduction to the concepts of feeder models (PD, LGD and EAD models).Â

Despite the non-prescriptive nature of the accounting principle, common practice suggest relying on the so-called probability of default (PD), loss given default (LGD) and exposure at default (EAD) framework. Banks estimate ECL as the present value of the above three parameters product over a one-year or lifetime horizon, depending upon experiencing a significant increase in credit risk since origination. Three main buckets are considered : stage1 (one-year ECL), stage 2( lifetime ECL), stage3 (impaired credits).

The concepts of Next 12 month probability of default (PD), Lifetime Probability of Default, marginal default and modeling and validation concepts of LGD and EAD for IFRS9 has been explained step by step from scratch using R Programming.

This course also explains how Expected Credit Losses (ECL) affects regulatory capital and ratios. Modeling concepts for low default portfolios and scare data modeling is also covered. For modeling, both Generalized Linear Models (GLMS) and Machine Learning (ML) modeling methodologies has been explained step by step from scratch.

Who this course is for:

- Students

- Risk Analytics Professionals

- Statisticians

- Experienced Risk Modelers

- For someone who wish to start/shift their career towards risk modeling

This course will introduce you to the concept of provisioning, background of IFRS9 and the journey to forward looking impairment calculation framework. The staging allocation process is covered in depth before the introduction to the concepts of feeder models (PD, LGD and EAD models).Â

Despite the non-prescriptive nature of the accounting principle, common practice suggest relying on the so-called probability of default (PD), loss given default (LGD) and exposure at default (EAD) framework. Banks estimate ECL as the present value of the above three parameters product over a one-year or lifetime horizon, depending upon experiencing a significant increase in credit risk since origination. Three main buckets are considered : stage1 (one-year ECL), stage 2( lifetime ECL), stage3 (impaired credits).

The concepts of Next 12 month probability of default (PD), Lifetime Probability of Default, marginal default and modeling and validation concepts of LGD and EAD for IFRS9 has been explained step by step from scratch using R Programming.

This course also explains how Expected Credit Losses (ECL) affects regulatory capital and ratios. Modeling concepts for low default portfolios and scare data modeling is also covered. For modeling, both Generalized Linear Models (GLMS) and Machine Learning (ML) modeling methodologies has been explained step by step from scratch.

Who this course is for:

- Students

- Risk Analytics Professionals

- Statisticians

- Experienced Risk Modelers

- For someone who wish to start/shift their career towards risk modeling

User Reviews

Rating

Subhashish Ray

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 38

- duration 4:49:16

- Release Date 2025/03/11