Hedge Funds Masters Program

EDUCBA Bridging the Gap

14:57:50

Description

A Complete Package - Classic Strategies| Performance Analysis| Concept of Leverage| Accounting & Taxation| Risk| etc

What You'll Learn?

- The course will help you learn about the Introduction to the concept of Hedge funds, its Definition and meaning, History, Features

- Structure of a hedge fund, Fee structure, Legislation, Current trends, Top HF

- The difference between Hedge fund and Mutual Fund.

- The course will help you learn about the most famous and used strategies in Hedge fund trading

- Leverage strategy, Long Only, Short Only, Equity Long Short , Market Neutral, Short Bias, Long Bias and Variable Bias.

- The course will help you learn about how performance analysis of hedge fund happens

Who is this for?

What You Need to Know?

More details

DescriptionHedge funds market has seen huge growth potential in last decade and seems to be expanding. Many are not aware of it and how they actually work. It is a self-study course based on interactive video sessions that would cover important aspects of Hedge Funds which would help its participants get an overview of this exciting market.

The course has been divided into logical sections which will help you learn the following

The course will help you learn about the Introduction to the concept of Hedge funds, its Definition and meaning, History, Features, Structure of a hedge fund, Fee structure, Legislation, Current trends, Top HF 2015 and the difference between Hedge fund and Mutual Fund.

The course will help you learn about the most famous and used strategies in Hedge fund trading. The strategies would be explained with the help of live case studies and examples along with the advantage and disadvantages of using these strategies. We shall also understand when best we should use them. These strategies include the leverage strategy, Long Only, Short Only, Equity Long Short , Market Neutral, Short Bias, Long Bias and Variable Bias.

The course will help you learn about how performance analysis of hedge fund happens. It would be explained with the help of live case studies and examples so that the learner can comprehend all about it. We shall also understand when best we should use them. These tutorials include understanding high water mark calculation, traditional performance measures, CAPM, sharpe ratio, sortino ratio, treynor ratio, information ratio, benchmark analysis, quartile chart, calmer ratio time series analysis, modern techniques in analyzing hedge fund performance.

The course will help you learn about accounting and taxation concepts of Hedge Funds. The tutorials will help you learn structure of hedge funds, carried interest, Bermuda, offshore funds, master feeder structure, US reporting requirements, accounting and accounting entries for hedge funds and finally look at NAV calculations with the help of examples.

The course will help you learn about risk management in Hedge Funds. The tutorials will help you learn about risk exposure, standard deviation, VaR, downside capture, drawdown, stress testing, sensitivity analysis, risk management software and finally we will discuss a case study to wrap up the entire learning on managing risks w.r.t hedge funds.

The course will help you learn from various success and failure hedge fund case studies. Understand the reasons for the failures and what could have been to avoid them. We will discuss case studies on companies such as Bridgewater, Tiger Management, Amaranth Advisors, LTCM, Soros Management.

Who this course is for:

- Equity research analyst, Bankers, Risk Managers, Credit Analyst

- Appropriate also for those who want to have a thorough understanding of the basic hedge fund strategies and the Industry

Hedge funds market has seen huge growth potential in last decade and seems to be expanding. Many are not aware of it and how they actually work. It is a self-study course based on interactive video sessions that would cover important aspects of Hedge Funds which would help its participants get an overview of this exciting market.

The course has been divided into logical sections which will help you learn the following

The course will help you learn about the Introduction to the concept of Hedge funds, its Definition and meaning, History, Features, Structure of a hedge fund, Fee structure, Legislation, Current trends, Top HF 2015 and the difference between Hedge fund and Mutual Fund.

The course will help you learn about the most famous and used strategies in Hedge fund trading. The strategies would be explained with the help of live case studies and examples along with the advantage and disadvantages of using these strategies. We shall also understand when best we should use them. These strategies include the leverage strategy, Long Only, Short Only, Equity Long Short , Market Neutral, Short Bias, Long Bias and Variable Bias.

The course will help you learn about how performance analysis of hedge fund happens. It would be explained with the help of live case studies and examples so that the learner can comprehend all about it. We shall also understand when best we should use them. These tutorials include understanding high water mark calculation, traditional performance measures, CAPM, sharpe ratio, sortino ratio, treynor ratio, information ratio, benchmark analysis, quartile chart, calmer ratio time series analysis, modern techniques in analyzing hedge fund performance.

The course will help you learn about accounting and taxation concepts of Hedge Funds. The tutorials will help you learn structure of hedge funds, carried interest, Bermuda, offshore funds, master feeder structure, US reporting requirements, accounting and accounting entries for hedge funds and finally look at NAV calculations with the help of examples.

The course will help you learn about risk management in Hedge Funds. The tutorials will help you learn about risk exposure, standard deviation, VaR, downside capture, drawdown, stress testing, sensitivity analysis, risk management software and finally we will discuss a case study to wrap up the entire learning on managing risks w.r.t hedge funds.

The course will help you learn from various success and failure hedge fund case studies. Understand the reasons for the failures and what could have been to avoid them. We will discuss case studies on companies such as Bridgewater, Tiger Management, Amaranth Advisors, LTCM, Soros Management.

Who this course is for:

- Equity research analyst, Bankers, Risk Managers, Credit Analyst

- Appropriate also for those who want to have a thorough understanding of the basic hedge fund strategies and the Industry

User Reviews

Rating

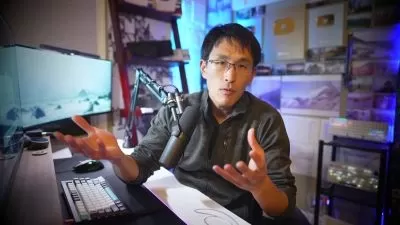

EDUCBA Bridging the Gap

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 115

- duration 14:57:50

- Release Date 2023/12/24