Foundations of Working Capital Management

Jim Stice and Earl Stice,Jim Stice and Earl Stice

1:46:09

Description

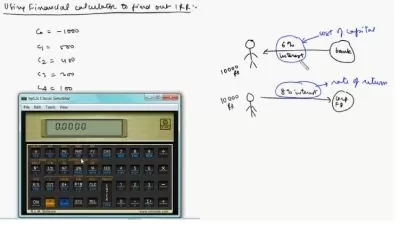

If you’re in any way involved with decision-making on the financial operations of a business, then you probably already know that working capital is a complex piece of the company puzzle. It can be tough to keep account of everything, though, on top of your day-to-day liabilities. What’s more, working capital requires proper management of both your tangible and intangible assets. In this course, accounting professors Jim and Kay Stice walk you through the various aspects of working capital in a merchandising business.

Learn about the most important moving parts in the operating cycle of your business: cash, accounts receivable, inventory, and accounts payable. Get pointers on how to manage your liabilities by using the company balance sheet. Jim and Kay give you the tools you need to track your financials more effectively, showing you how to create organized, well-documented internal operating procedures to ensure the proper management of working capital.

More details

User Reviews

Rating

Jim Stice and Earl Stice

Instructor's CoursesJim Stice and Earl Stice

Instructor's Courses

Linkedin Learning

View courses Linkedin Learning- language english

- Training sessions 25

- duration 1:46:09

- Release Date 2023/01/09