Financial and Management Accounting Crash Course

Adrian Resag, QIAL, CMIIA, CIA, CISA, CRMA, CFSA, GRCP, CIMA Adv Dip MA

1:19:32

Description

Crash course to quickly give you the basics of financial and management accounting

What You'll Learn?

- Know about the qualities of financial information, dual-entry accounting, cash-basis accounting and financial statements and their assertions.

- Be able to use the different methods to recognize revenue.

- Be able to use the different methods of depreciation.

- Be able to use methods of leasing from the point of view of the lessee and the lessor.

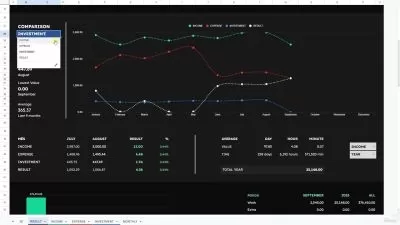

- Know how to analyze financial information through the use of ratio analysis.

- Know the basics of management accounting, such as present and future values, net present value, the internal rate of return and the accounting rate of return.

- Know the different types of cost accounting systems and about responsibility accounting.

- Be able to use different systems for costing.

Who is this for?

More details

DescriptionWe are glad to bring you the Financial and Management Accounting Crash Course.

This course is ideal for variety of people, including:

Students in accounting, finance or business courses who want an overview of financial and management accounting in a crash course format.

Business managers, financial accountants and management accountants who want a refresher on financial and management accounting.

Anyone with an interest in financial and management accounting.

The course will give you the knowledge and tools necessary in basic financial and management accounting. Learn about using and creating financial information, recognizing revenue, the methods to depreciate assets, leasing, how to analyze information through the use of ratio analysis, management accounting, cost and responsibility accounting and costing systems.

It is taught by Adrian Resag, who has worked as an accountant and has taught financial and managing accounting in university and to many companies and governmental organizations.

The course covers:

Financial Accounting and Financial Statements

Know about the qualities of financial information, dual-entry accounting, cash-basis accounting and financial statements and their assertions.

Revenue Recognition

Be able to use the different methods to recognize revenue.

Methods of Depreciation

Be able to use the different methods of depreciation.

Leasing

Be able to use methods of leasing from the point of view of the lessee and the lessor.

Ratio Analysis

Know how to analyze financial information through the use of ratio analysis.

Management Accounting

Know the basics of management accounting, such as present and future values, net present value, the internal rate of return and the accounting rate of return.

Cost Accounting and Responsibility Accounting

Know the different types of cost accounting systems and about responsibility accounting.

Costing Systems

Be able to use different systems for costing.

Who this course is for:

- Students in accounting, finance or business courses who want an overview of financial and management accounting in a crash course format.

- Business managers, financial accountants and management accountants who want a refresher on financial and management accounting.

We are glad to bring you the Financial and Management Accounting Crash Course.

This course is ideal for variety of people, including:

Students in accounting, finance or business courses who want an overview of financial and management accounting in a crash course format.

Business managers, financial accountants and management accountants who want a refresher on financial and management accounting.

Anyone with an interest in financial and management accounting.

The course will give you the knowledge and tools necessary in basic financial and management accounting. Learn about using and creating financial information, recognizing revenue, the methods to depreciate assets, leasing, how to analyze information through the use of ratio analysis, management accounting, cost and responsibility accounting and costing systems.

It is taught by Adrian Resag, who has worked as an accountant and has taught financial and managing accounting in university and to many companies and governmental organizations.

The course covers:

Financial Accounting and Financial Statements

Know about the qualities of financial information, dual-entry accounting, cash-basis accounting and financial statements and their assertions.

Revenue Recognition

Be able to use the different methods to recognize revenue.

Methods of Depreciation

Be able to use the different methods of depreciation.

Leasing

Be able to use methods of leasing from the point of view of the lessee and the lessor.

Ratio Analysis

Know how to analyze financial information through the use of ratio analysis.

Management Accounting

Know the basics of management accounting, such as present and future values, net present value, the internal rate of return and the accounting rate of return.

Cost Accounting and Responsibility Accounting

Know the different types of cost accounting systems and about responsibility accounting.

Costing Systems

Be able to use different systems for costing.

Who this course is for:

- Students in accounting, finance or business courses who want an overview of financial and management accounting in a crash course format.

- Business managers, financial accountants and management accountants who want a refresher on financial and management accounting.

User Reviews

Rating

Adrian Resag, QIAL, CMIIA, CIA, CISA, CRMA, CFSA, GRCP, CIMA Adv Dip MA

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 42

- duration 1:19:32

- Release Date 2023/01/22