Excel for Finance: Building a Three-Statement Operating Model

Focused View

Chris Reilly

4:59:23

25 View

01 - FP&A in Excel.mp4

00:55

02 - What you should know.mp4

01:24

03 - What youre going to build.mp4

04:11

01 - Call with the CFO.mp4

03:26

02 - Initial groundwork and freeze frames.mp4

03:08

03 - Identifying hardcoded data.mp4

02:19

04 - Applying the currency format.mp4

03:28

05 - The value of a placeholder row.mp4

04:07

06 - Initial error checking.mp4

03:02

07 - Expanding on error checking.mp4

05:50

08 - Formatting guide.mp4

02:42

09 - Indenting and cleanup.mp4

03:43

01 - Build the cash from operations.mp4

07:35

02 - Build the cash from investing.mp4

02:58

03 - Build the cash from financing.mp4

03:27

04 - Build the change in cash and ending cash.mp4

05:59

01 - An overview of EBITDA.mp4

04:54

02 - Building the EBITDA schedule.mp4

08:39

01 - Foundation of a good forecast.mp4

07:34

02 - Build the annual income statement.mp4

05:53

03 - Build the annual balance sheet.mp4

04:29

04 - Calculating year-over-year growth.mp4

04:39

05 - Forecasting the revenue.mp4

06:55

06 - Forecasting the cost of goods sold.mp4

06:17

07 - Forecasting the variable expenses.mp4

06:30

08 - Forecasting the fixed expenses.mp4

04:08

09 - Forecasting the headcount.mp4

05:30

10 - Headcount in outer years.mp4

05:59

11 - Forecast the income tax expense.mp4

02:41

01 - An overview of the balance sheet.mp4

01:40

02 - How to lay the net working capital.mp4

03:51

03 - Forecasting the accounts receivable.mp4

06:40

04 - Forecasting the inventory.mp4

03:11

05 - Forecasting the accounts payable.mp4

03:20

06 - Modeling prepaid expenses and accruals.mp4

06:31

07 - Building the bonus accrual.mp4

11:10

08 - Building the tax accrual.mp4

09:27

01 - An overview of CapEx and depreciation.mp4

04:22

02 - How to lay the fixed assets schedule.mp4

02:50

03 - Building the CapEx forecast.mp4

04:36

04 - Building the depreciation waterfall.mp4

08:40

05 - Modeling existing depreciation.mp4

03:16

06 - Connecting the fixed assets to the model.mp4

04:16

07 - Quick cleanup.mp4

03:48

08 - How to lay the debt schedule.mp4

04:45

09 - Groundwork of the cash flow sweep.mp4

06:30

10 - Finishing the cash flow sweep.mp4

04:56

11 - Modeling the revolver.mp4

04:59

12 - Getting started with term debt.mp4

03:03

13 - Setting up term debt amortization.mp4

04:00

14 - Modeling the term debt amortization.mp4

04:38

15 - Connecting the debt schedule to the model.mp4

05:26

01 - Model the leverage ratio.mp4

07:26

02 - Model the fixed charge coverage ratio.mp4

08:46

01 - Pre-summary cleanup.mp4

08:07

02 - Link up the one-pager Part 1.mp4

08:32

03 - Link up the one-pager Part 2.mp4

05:28

04 - Stress testing the model.mp4

03:57

01 - Email to the CFO.mp4

03:16

02 - Epilogue Real-life application of the model.mp4

05:34

Description

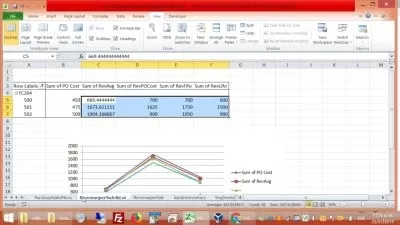

A three-statement operating model incorporates your company’s income statement, balance sheet, and cash flow statement to provide an integrated and complete view of your organization’s financial health. Follow along with Chris Reilly, financial modeling expert and experienced Excel trainer, as he shows you how to build a three-statement model in Excel. Chris explains how to clean up source data, build the cash flow statement, build EBITDA, and forecast the income statement, balance sheet, debt schedule, and more.

More details

User Reviews

Rating

average 0

Focused display

Category

Chris Reilly

Instructor's Courses

Linkedin Learning

View courses Linkedin LearningLinkedIn Learning is an American online learning provider. It provides video courses taught by industry experts in software, creative, and business skills. It is a subsidiary of LinkedIn. All the courses on LinkedIn fall into four categories: Business, Creative, Technology and Certifications.

It was founded in 1995 by Lynda Weinman as Lynda.com before being acquired by LinkedIn in 2015. Microsoft acquired LinkedIn in December 2016.

- language english

- Training sessions 60

- duration 4:59:23

- English subtitles has

- Release Date 2023/12/13