Credit Risk Modeling using R Programming

Subhashish Ray

4:15:49

Description

Learn end to end credit risk scorecard and probability of default (PD) modeling using R Programming with real-life data

What You'll Learn?

- Learn Model Development from scratch

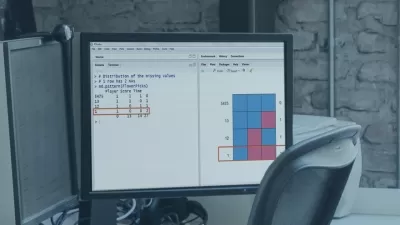

- Understand step by step application of R codes

- Understand output interpretation and it's business logic

- Aligning Analytics with Business Requirements

- Impress interviewers by showing practical knowledge of credit risk model development

- Learn the most in demand skill

Who is this for?

More details

DescriptionEvery time an institution extends a loan, it faces credit risk. It is the risk of economic loss that every financial institution faces when an obligor does not fulfill the terms and conditions of his contracts. Measuring and managing the credit risk and developing, implementing strategies to help lowering the risk of defaults by borrowers becomes the core of any risk management activities.

Financial institutions make use of vast amounts of data on borrowers and loans and apply these predictive and statistical models to aid banks in quantifying, aggregating and managing credit risk across geographies and product lines.

In this course, our objective is to learn how to build these credit risk models step by step from scratch using a real life dataset.

The course comprises of two sections: 1) Developing a credit risk scorecard and 2) Developing a Probability of Default (PD) model. We will build a predictive model that takes as input the various aspects of the loan applicant and outputs the probability of default of the loan applicant. PD is also the primary parameter used in calculating credit risk as per the internal ratings-based approach (under Basel guidelines) used by banks.

In this course, we will perform all the steps involved in model building and along the way, we will also understand the entire spectrum of the predictive modeling landscape.

Â

Who this course is for:

- Beginners/students

- Experienced analytics professional

- working professionals who want to shift towards risk modeling

- Data science/machine learning enthusiasts who want to learn a new skill

Every time an institution extends a loan, it faces credit risk. It is the risk of economic loss that every financial institution faces when an obligor does not fulfill the terms and conditions of his contracts. Measuring and managing the credit risk and developing, implementing strategies to help lowering the risk of defaults by borrowers becomes the core of any risk management activities.

Financial institutions make use of vast amounts of data on borrowers and loans and apply these predictive and statistical models to aid banks in quantifying, aggregating and managing credit risk across geographies and product lines.

In this course, our objective is to learn how to build these credit risk models step by step from scratch using a real life dataset.

The course comprises of two sections: 1) Developing a credit risk scorecard and 2) Developing a Probability of Default (PD) model. We will build a predictive model that takes as input the various aspects of the loan applicant and outputs the probability of default of the loan applicant. PD is also the primary parameter used in calculating credit risk as per the internal ratings-based approach (under Basel guidelines) used by banks.

In this course, we will perform all the steps involved in model building and along the way, we will also understand the entire spectrum of the predictive modeling landscape.

Â

Who this course is for:

- Beginners/students

- Experienced analytics professional

- working professionals who want to shift towards risk modeling

- Data science/machine learning enthusiasts who want to learn a new skill

User Reviews

Rating

Subhashish Ray

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 29

- duration 4:15:49

- Release Date 2023/05/13