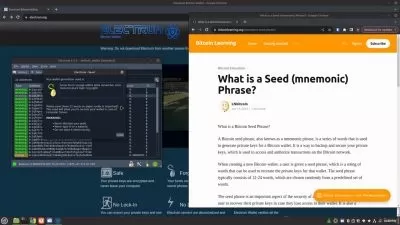

About BitcoinLearn More

Bitcoin is a type of electronic money that is not involved in its transmission, transfer and management by an intermediary institution, and its control is in the hands of the people. In this monetary system, people are their own banks and transfer money to each other directly without the need for a bank or centralized institution.

Cryptocurrencies have great features and capabilities. Cryptocurrencies operate on a large network platform called "Blockchain". This network has many users and its data cannot be tampered with.

Sort by:

Sorting

The newest

Most visited

Course time

Subtitle

Filtering

Courses

Subtitle

Linkedin Learning

Tom Geller

Learning Bitcoin and Other Cryptocurrencies 1:12:50

English subtitles

09/17/2024

Subtitle

Udemy

Pleb Lab

PlebDevs Course I: Building a Lightning Wallet Frontend 6:31:19

English subtitles

03/01/2024

Books

Frequently asked questions about Bitcoin

Bitcoin is an open-sourced cryptocurrency created in 2009. It does not require the use of banking institutions and can be used anonymously. Because it does not originate from any specific country or region, it is not subject to regulation. Unlike most currencies today, which rely on a centralized, heavily regulated “fiat” system, Bitcoin is decentralized and unregulated. It is distributed by means of a public ledger using blockchain technology. The supply is capped at 21 million, and its value is determined by demand and the perceived benefits to users.

Bitcoin is one of the first and the most recognizable cryptocurrencies. Since cryptocurrencies depend on widespread acceptance and use to drive up value, Bitcoin has a head start on most of its competitors. On the downside, however, Bitcoin uses an incredible amount of computing power, making the system’s energy consumption a cause for worry among investors. Ethereum encourages the creation of new applications on its blockchain, and it uses significantly less energy than Bitcoin. The availability of “smart contracts” that run on the Ethereum blockchain allows for safe transactions without a third party.

Bitcoin mining is the acceptable process for entering new bitcoins into circulation. Basically, miners work on verifying bitcoin transactions, and they are paid when a “block” of transactions is completed and added to the blockchain. This system produces a two-sided benefit. Miners are paid for their work, and their work serves to secure the bitcoin system from fraud. It prevents a Bitcoin owner from using the same Bitcoin for more than one transaction. Miners earn income from both solving hash problems and validating the solutions of other miners.