Automate GST Reconciliation- Using Power Query

Mahesh Jhawar

2:02:52

Description

Automate GST Reconciliation Between GSTR 2B and Purchase Register

What You'll Learn?

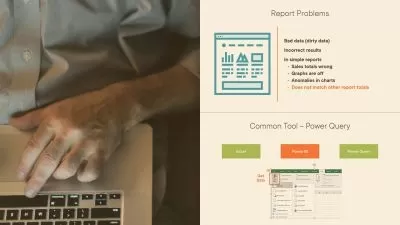

- Understand the Concepts of GST Reconciliation

- Automate GST Reconciliation Between GSTR 2B and Purchase Register

- Customize Final Reports as per Business Needs

- Blend Pro- Quality Business Intelligence Solutions to Blend and Analyze data from multiple sources.

Who is this for?

What You Need to Know?

More details

DescriptionUnlock the full potential of your business's financial data with our comprehensive course on Automating GST Reconciliation; designed for professionals seeking to enhance their GST compliance and data analysis skills. This course will guide you through reconciling GSTR 2B with your Purchase Register.

Our course begins with a deep dive into the principles and concepts behind GST reconciliation. You'll gain a thorough understanding of how to compare GSTR 2B with your Purchase Register, identifying discrepancies and ensuring accurate compliance. We emphasize the importance of accuracy and efficiency in GST processes, teaching you the latest automation techniques to reduce manual errors and save valuable time.

Learn to automate reconciliation processes, customize final reports to meet specific business needs, and integrate data from multiple sources using advanced Business Intelligence solutions.

Gain a deep understanding of GST reconciliation concepts, followed by hands-on projects that simulate real-world scenarios. Our expert instructors will provide step-by-step tutorials and interactive sessions, ensuring you grasp the intricacies of automation techniques and customized reporting. Access downloadable templates and tools tailored to your requirements, making GST reconciliation seamless and efficient.

Ideal for CFO's, Chartered Accountants, Cost Management Accountants, Financial professionals, business owners, accountants and data analysts, this course emphasizes practical applications and real-world scenarios. With flexible learning options and lifetime access to materials, you can study at your own pace. Enhance your data management practices, automate processes, and create impactful reports with our expert-led course. Enroll today and transform your approach to GST reconciliation, driving better business decisions with comprehensive data insights.

Who this course is for:

- GST Consultants

- Accounts Executives

- Finance Managers

- CFO

- GST Practioner

- Accountants

- Chartered Accountants

- Cost Management Accountants

Unlock the full potential of your business's financial data with our comprehensive course on Automating GST Reconciliation; designed for professionals seeking to enhance their GST compliance and data analysis skills. This course will guide you through reconciling GSTR 2B with your Purchase Register.

Our course begins with a deep dive into the principles and concepts behind GST reconciliation. You'll gain a thorough understanding of how to compare GSTR 2B with your Purchase Register, identifying discrepancies and ensuring accurate compliance. We emphasize the importance of accuracy and efficiency in GST processes, teaching you the latest automation techniques to reduce manual errors and save valuable time.

Learn to automate reconciliation processes, customize final reports to meet specific business needs, and integrate data from multiple sources using advanced Business Intelligence solutions.

Gain a deep understanding of GST reconciliation concepts, followed by hands-on projects that simulate real-world scenarios. Our expert instructors will provide step-by-step tutorials and interactive sessions, ensuring you grasp the intricacies of automation techniques and customized reporting. Access downloadable templates and tools tailored to your requirements, making GST reconciliation seamless and efficient.

Ideal for CFO's, Chartered Accountants, Cost Management Accountants, Financial professionals, business owners, accountants and data analysts, this course emphasizes practical applications and real-world scenarios. With flexible learning options and lifetime access to materials, you can study at your own pace. Enhance your data management practices, automate processes, and create impactful reports with our expert-led course. Enroll today and transform your approach to GST reconciliation, driving better business decisions with comprehensive data insights.

Who this course is for:

- GST Consultants

- Accounts Executives

- Finance Managers

- CFO

- GST Practioner

- Accountants

- Chartered Accountants

- Cost Management Accountants

User Reviews

Rating

Mahesh Jhawar

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 12

- duration 2:02:52

- Release Date 2024/10/11