Applications of Machine Learning in Trading

Hudson and Thames Quantitative Research

4:41:08

Description

Reading Group -- Early Access --

What You'll Learn?

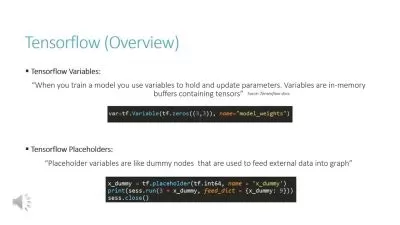

- Understand Core Machine Learning Concepts and Theories

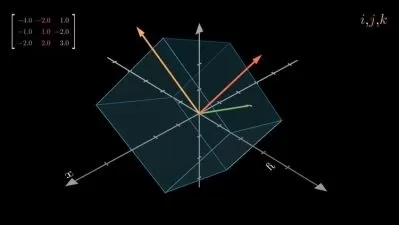

- Gain a comprehensive understanding of the mathematical principles underlying machine learning algorithms

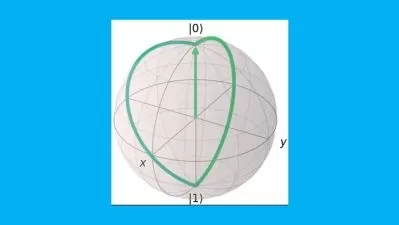

- Explore the Frontiers of Machine Learning Theory: Students will engage with the latest research and theoretical advancements in machine learning

- Ethical Considerations and Theoretical Limitations

Who is this for?

What You Need to Know?

More details

DescriptionDive into the essence of machine learning, not through mere tool usage, but by unraveling its core principles via the lens of quantitative finance case studies. This course is meticulously crafted to establish a solid foundation in the theory and mathematical underpinnings of machine learning. With this theoretical groundwork in place, we then transition into a series of detailed research papers, each carefully selected to enrich your understanding and illustrate the practical applications of these concepts within the realm of quantitative finance.

The course is designed to first impart a solid understanding of the theory and mathematical foundations underpinning each section. Following this theoretical grounding, we delve into case studies and research papers to enrich your comprehension, illustrating the practical application of these concepts in quantitative finance.

This approach ensures a robust grasp of both the abstract and practical aspects of machine learning, providing you with a comprehensive insight into its deployment in the financial domain. Through detailed case studies, we'll explore the nuances of algorithmic trading, risk management, asset pricing, and portfolio optimization, demonstrating how machine learning can uncover insights from vast datasets and drive decision-making.

This blend of theory, case study analysis, and interactive learning equips you with not just knowledge, but the confidence to apply machine learning innovations in quantitative finance.

Whether you're a financial professional seeking to leverage machine learning for strategic decision-making, a mathematician curious about the financial applications of these algorithms, or someone entirely new to either field, this course is designed to equip you with the knowledge, skills, and insight to navigate and excel in the intersection of machine learning and finance.

Who this course is for:

- Tailored for beginners in quantitative finance who wish to gain a good overview in Machine Learning

- Any graduate or professional with a mathematical background seeking to learn Machine Learning techniques

Dive into the essence of machine learning, not through mere tool usage, but by unraveling its core principles via the lens of quantitative finance case studies. This course is meticulously crafted to establish a solid foundation in the theory and mathematical underpinnings of machine learning. With this theoretical groundwork in place, we then transition into a series of detailed research papers, each carefully selected to enrich your understanding and illustrate the practical applications of these concepts within the realm of quantitative finance.

The course is designed to first impart a solid understanding of the theory and mathematical foundations underpinning each section. Following this theoretical grounding, we delve into case studies and research papers to enrich your comprehension, illustrating the practical application of these concepts in quantitative finance.

This approach ensures a robust grasp of both the abstract and practical aspects of machine learning, providing you with a comprehensive insight into its deployment in the financial domain. Through detailed case studies, we'll explore the nuances of algorithmic trading, risk management, asset pricing, and portfolio optimization, demonstrating how machine learning can uncover insights from vast datasets and drive decision-making.

This blend of theory, case study analysis, and interactive learning equips you with not just knowledge, but the confidence to apply machine learning innovations in quantitative finance.

Whether you're a financial professional seeking to leverage machine learning for strategic decision-making, a mathematician curious about the financial applications of these algorithms, or someone entirely new to either field, this course is designed to equip you with the knowledge, skills, and insight to navigate and excel in the intersection of machine learning and finance.

Who this course is for:

- Tailored for beginners in quantitative finance who wish to gain a good overview in Machine Learning

- Any graduate or professional with a mathematical background seeking to learn Machine Learning techniques

User Reviews

Rating

Hudson and Thames Quantitative Research

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 14

- duration 4:41:08

- Release Date 2024/04/28