Advanced Financial Modeling for Renewable Energy - ( US )

Greg Ahuy

14:23:23

Description

Tax Equity Flip Structure

What You'll Learn?

- How to model the allocations of tax benefits between tax equity and sponsor, including the capital accounts, DRO, Qualifies Income Offset, and outside basis;

- How to size tax equity investment in a yield-based flip;

- Optimize the model to achieve the requirements of lender, sponsor and tax equity investor;

- How to size debt based on multiple covenants for wind and solar projects;

- How to create best practice macro’s and Excel VBA codes to break circularities;

- How renewable projects are financed;

- Gain insights into the financial model development process, step-by-step – for a renewable energy model;

Who is this for?

What You Need to Know?

More details

DescriptionCourse Objective

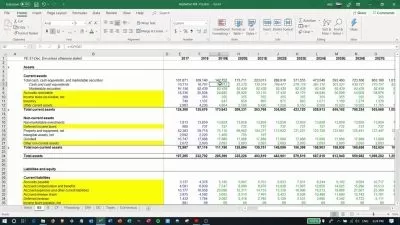

In an online environment, you will build a financial model suitable for advanced analysis of tax equity flip structures for wind and solar projects.

This course will provide step-by-step instructions on how to size tax equity investment, back-leverage loan, and how to estimate the sponsor's equity return.

By the end of this course, you will be able to build complex, real-life project finance models to analyze tax equity flip structures.

What This Course is About?

Project finance models are used to assess the risk-reward of lending to and investing in an infrastructure project. The project's debt capacity, valuation and financial feasibility depend on expected future cash flows generated by the project and a financial model is built to analyze this. In the tax equity flip structures, there is additional complexity related to the IRS tax rules that have to be reflected in the financial model. On top of that, we have to be able to correctly size the back-leverage debt in the downside scenario, taking into account and reflecting the tax equity's seniority in the financial model.

In this course, we will model a complex tax equity flip structure for wind and solar projects in excel.

You will learn about:

How renewable projects are financed;

How to create best practice macro’s and Excel VBA codes to break circularities;

How to size debt based on multiple covenants for wind and solar projects;

how to create best practice macro’s and VBA codes to break circularities

How to model the allocations of tax benefits between tax equity and sponsor, including modeling the capital accounts, DRO, Qualifies Income Offset provisions, and outside basis;

How to size tax equity investment in a yield-based flip;

Optimize the model to achieve the requirements of lender, sponsor and tax equity investor;

Gain insights into the financial model development process, step-by-step – for a renewable energy model;

This is the same comprehensive financial training used to prepare analysts and managers at top financial institutions and infrastructure funds.

How Does It Work?

The course length is over 14 hours.

First, we will review how renewable energy projects get financed, so we understand all the essential components of project finance transaction.

Then, we will go over the case study and review modeling methods to improve our productivity in excel. We will then dive into building our advanced financial model. We will model the tax benefits allocation and cash distributions before adjustments between partners, which will give us the correct cash flow to the parties.

Next, we will size a preliminary back-leverage loan and model the construction funding. Once we have the construction funding, we will work on the adjustments that have to be made to the tax benefits allocated to the tax equity partner. We will implement the IRS requirements in the financial model (capital accounts, DRO, Qualified Income Offset, outside basis). This will allow us to size the tax equity's investment correctly.

We will then finalize the calculations of the cash flow available for the distributions to the sponsor. We will have to incorporate the DSCR lock-up and default covenants, and debt service reserve account into the calculations of the sponsor's cash flow to get to the sponsor's IRR.

Next, we will work on scenario analysis to find a tax equity transaction structure that could enhance the value of the project for the sponsor and the tax equity partner.

And, finally, we will work on modeling the partners' equity return when the sponsor exercises his buyout option. For those, who are interested in the accounting side of the tax equity transaction, we will also include the discussion and modeling of the HLBV accounting.

Is This Course For You?

Yes, if you need to build, review or analyse project finance models for wind and solar projects in the United States.

Typical students include analysts, managers, senior managers, associate directors, financial advisors, financiers and CFOs from project companies, investment banks, private equity and infrastructure funds.

Course Prerequisites

Note that this is an advanced financial modeling course, and it is expected that you know how to model the project finance models for renewable energy projects. Most of our students take our other course "Project Finance Modeling for Renewable Energy" before taking the advanced course.

Who this course is for:

- Typical students include analysts, managers, senior managers, associate directors, financial advisors, financiers and CFOs from project companies, investment banks, private equity and infrastructure funds.

Course Objective

In an online environment, you will build a financial model suitable for advanced analysis of tax equity flip structures for wind and solar projects.

This course will provide step-by-step instructions on how to size tax equity investment, back-leverage loan, and how to estimate the sponsor's equity return.

By the end of this course, you will be able to build complex, real-life project finance models to analyze tax equity flip structures.

What This Course is About?

Project finance models are used to assess the risk-reward of lending to and investing in an infrastructure project. The project's debt capacity, valuation and financial feasibility depend on expected future cash flows generated by the project and a financial model is built to analyze this. In the tax equity flip structures, there is additional complexity related to the IRS tax rules that have to be reflected in the financial model. On top of that, we have to be able to correctly size the back-leverage debt in the downside scenario, taking into account and reflecting the tax equity's seniority in the financial model.

In this course, we will model a complex tax equity flip structure for wind and solar projects in excel.

You will learn about:

How renewable projects are financed;

How to create best practice macro’s and Excel VBA codes to break circularities;

How to size debt based on multiple covenants for wind and solar projects;

how to create best practice macro’s and VBA codes to break circularities

How to model the allocations of tax benefits between tax equity and sponsor, including modeling the capital accounts, DRO, Qualifies Income Offset provisions, and outside basis;

How to size tax equity investment in a yield-based flip;

Optimize the model to achieve the requirements of lender, sponsor and tax equity investor;

Gain insights into the financial model development process, step-by-step – for a renewable energy model;

This is the same comprehensive financial training used to prepare analysts and managers at top financial institutions and infrastructure funds.

How Does It Work?

The course length is over 14 hours.

First, we will review how renewable energy projects get financed, so we understand all the essential components of project finance transaction.

Then, we will go over the case study and review modeling methods to improve our productivity in excel. We will then dive into building our advanced financial model. We will model the tax benefits allocation and cash distributions before adjustments between partners, which will give us the correct cash flow to the parties.

Next, we will size a preliminary back-leverage loan and model the construction funding. Once we have the construction funding, we will work on the adjustments that have to be made to the tax benefits allocated to the tax equity partner. We will implement the IRS requirements in the financial model (capital accounts, DRO, Qualified Income Offset, outside basis). This will allow us to size the tax equity's investment correctly.

We will then finalize the calculations of the cash flow available for the distributions to the sponsor. We will have to incorporate the DSCR lock-up and default covenants, and debt service reserve account into the calculations of the sponsor's cash flow to get to the sponsor's IRR.

Next, we will work on scenario analysis to find a tax equity transaction structure that could enhance the value of the project for the sponsor and the tax equity partner.

And, finally, we will work on modeling the partners' equity return when the sponsor exercises his buyout option. For those, who are interested in the accounting side of the tax equity transaction, we will also include the discussion and modeling of the HLBV accounting.

Is This Course For You?

Yes, if you need to build, review or analyse project finance models for wind and solar projects in the United States.

Typical students include analysts, managers, senior managers, associate directors, financial advisors, financiers and CFOs from project companies, investment banks, private equity and infrastructure funds.

Course Prerequisites

Note that this is an advanced financial modeling course, and it is expected that you know how to model the project finance models for renewable energy projects. Most of our students take our other course "Project Finance Modeling for Renewable Energy" before taking the advanced course.

Who this course is for:

- Typical students include analysts, managers, senior managers, associate directors, financial advisors, financiers and CFOs from project companies, investment banks, private equity and infrastructure funds.

User Reviews

Rating

Greg Ahuy

Instructor's Courses

Udemy

View courses Udemy- language english

- Training sessions 103

- duration 14:23:23

- English subtitles has

- Release Date 2024/05/04

![Financial Modeling [2023]: Complete finance course on Excel](https://traininghub.ir/image/course_pic/16253-x225.webp)